Individual

Super & Pension

Australian Ethical members

Former Christian Super members

Managed Funds

All managed funds (except Altius)

Altius fixed income funds

Adviser

Super & Pension (GROW)

Managed funds

Employer

Australian Ethical employers

Former Christian Super employers

News & insights

News & insights

All (135)

News & updates (28)

Ethical investing (45)

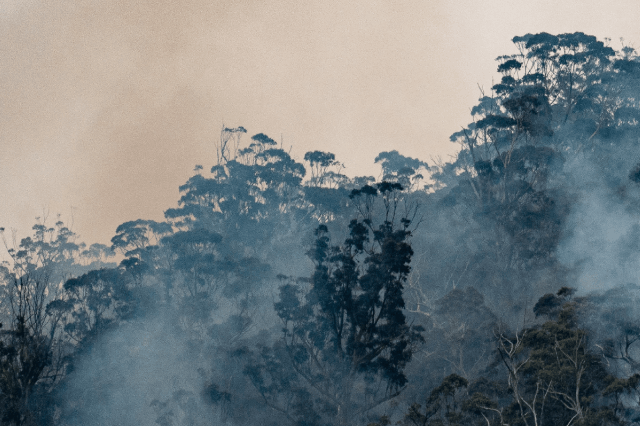

Climate action (29)

Animal protection (10)

Human rights & equality (5)

Super & investments (39)

Philanthropy (5)

Retirement (16)

Managed Funds (3)

Insurance (4)

Ethical stewardship (12)

Explore