Super with heart

Award-winning# Australian super fund for people who want to do well by doing good.

When you prosper, we all thrive

By choosing Australian Ethical, you are committing your money to doing right by people, planet and animals.

Invest with values at the core

Feel better about your super by investing in a award-winning# fund which aligns with your values

Help build a better world

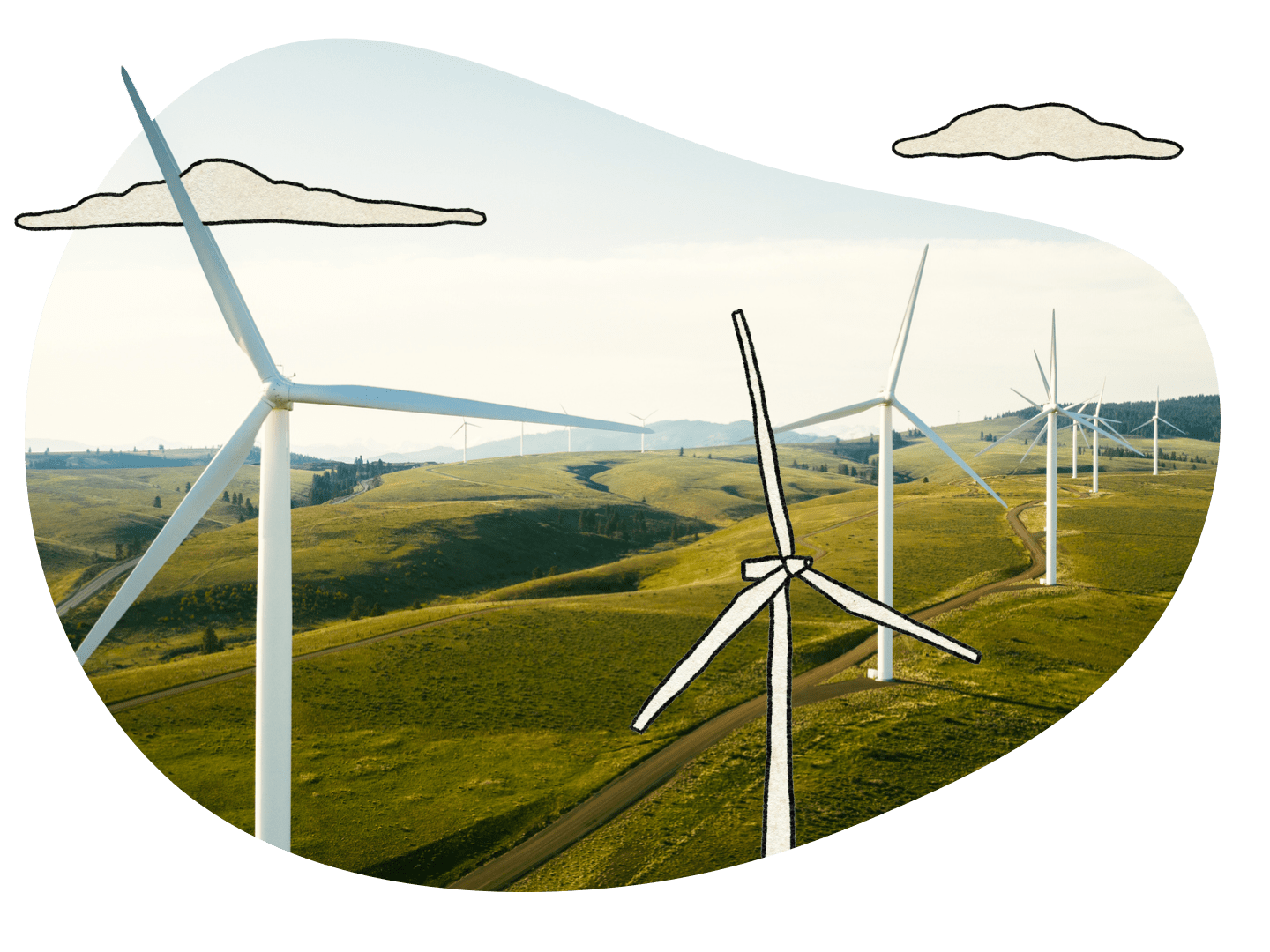

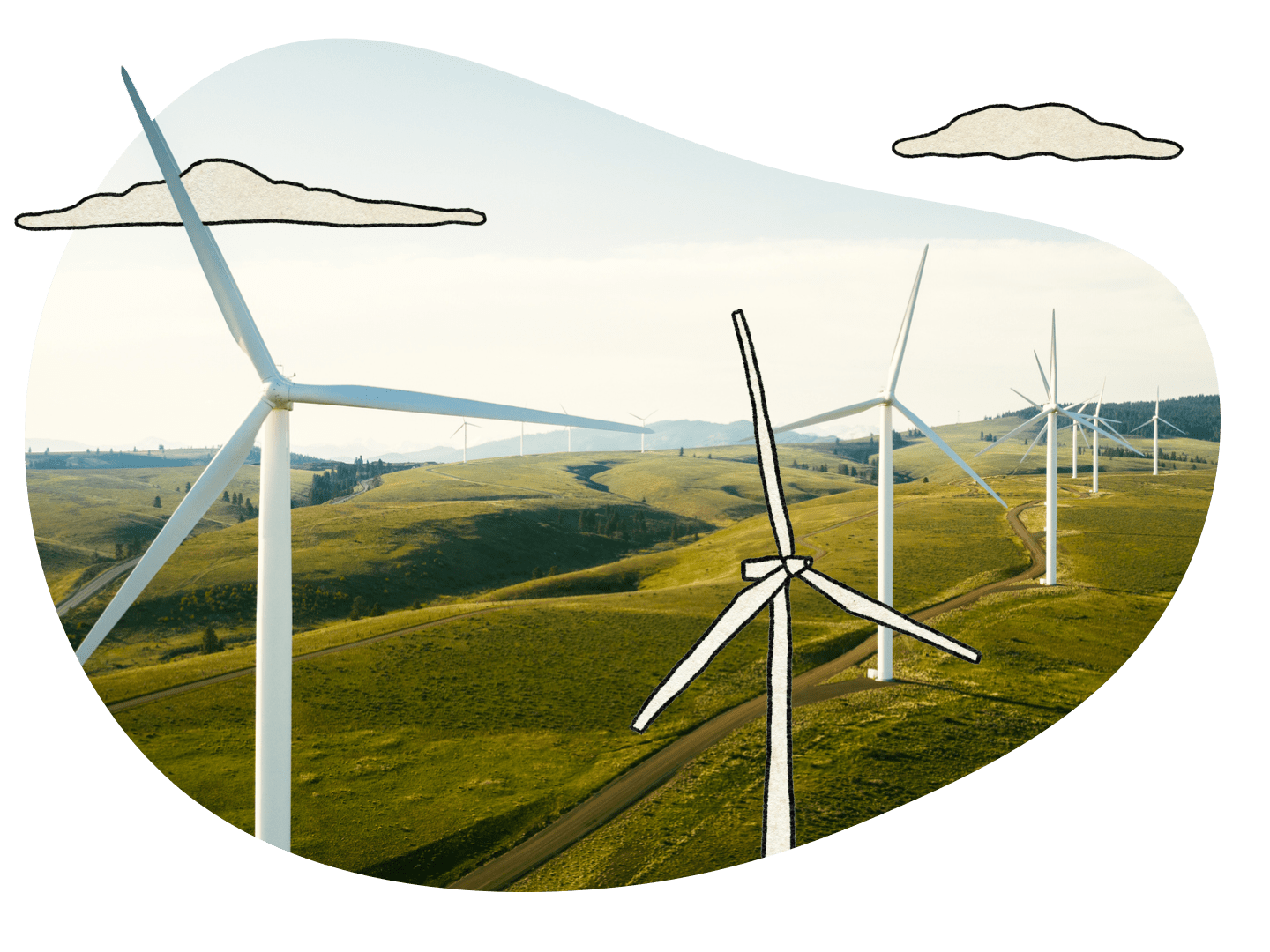

Help contribute to a low-carbon future by investing in companies that are part of the solution and restricting+ those that aren’t

Won’t break your heart

We restrict+ investments that could pollute, destroy, harm or exploit, like fossil fuels

For more information on revenue thresholds and how we assess, visit our Ethical Guide.

Long-term track record you can love

If you’ve ever wondered whether an ethical super can deliver, our results show it can.

Australian Shares Super option

p.a., rated #16 for returns over 10 years out of 39 funds1

SuperRating Fund Crediting Rate Survey - SR Australian Shares Index as at 30 September 2025.

Overall industry median

returns over 10 years p.a.

SuperRating Fund Crediting Rate Survey - SR Australian Shares Index as at 30 September 2025.

*Past performance is not a reliable indicator of future performance.

Returns are calculated net of investment fees, tax and implicit asset-based administration fees. Explicit fees such as fixed dollar administration fees, exit fees, contribution fees and switching fees are excluded.

Only ethical super options

Australian Ethical gives you access to a range of ethical super investment options. Making the choice that’s right for you financially is important^.

What you can be sure of is that all our investments are subjected to our ethical screening process+. This means whatever option you choose; we’re working to keep your investments aligned to ethical values.

But are we a good match for you?

Award-winning super

Our award-winning# investment team has shown that an ethical approach to investing can deliver healthy* returns.

Money magazine Best of the Best 2026 - Best ESG Super Product

Super Review Super Fund of the Year Awards 2025 – Sustainable Fund of the Year

Rainmaker ESG Leader 2025

Invest with heart

Join nowFrequently asked questions

Australian Ethical follows a 23-point Ethical Charter that doesn’t just restrict+ harmful industries but actively looks for opportunities that help people, animals and the planet. Ethical investing is all we do and have done for nearly 40 years. Our award-winning# investment team has shown that an ethical approach to investing can deliver long-term returns.

An ethical superannuation fund helps you build your future in a way that matches your values. Your money supports industries that make a difference as we restrict+ investments in negative activities like fossil fuels, nuclear, tobacco, and support positive ones in renewables, healthcare, IT and more. Step by step, our expert in-house ethics team applies our Ethical Criteria to navigate complex ethical issues raised by investments across the economy. It’s a simple way to grow your super while knowing your investments are contributing to a better world.

Ethical super funds can perform just as well as traditional ones. At Australian Ethical, our track record shows that investing responsibly is able to deliver long-term results. While past performance doesn’t guarantee future results, our focus on future-focused industries helps position your super for steady, long-term growth.

Yes, you can transfer your account balance with an existing superannuation fund to Australian Ethical. We know switching super can feel confusing, so we’ve made it simple to do online. Even though super funds can't charge exit fees, there may be other fees or tax impacts when you switch funds. It’s a good idea to check if your current fund has any insurance linked to it before you make the move.

Yes. You can choose from different investment options depending on your financial goals and how much risk you’re comfortable with. Whether you prefer a balanced mix or a growth-focused approach, every option follows the same ethical principles so your money always goes towards something good.

Yes. Eligible members can automatically access insurance through their super, including Death and Total & Permanent Disablement (TPD) cover. It’s there to give you and your family added peace of mind if something unexpected happens. You can review or change your cover anytime through your online account. You can also apply for income protection in your super account.

We’re here to make managing your investment simple. Members can track their balance, check performance and make updates online anytime. Our team is also easy to reach and ready to help with any questions about your super and pension accounts.

Your super generally stays with you (‘stapled’) when you change jobs unless you choose otherwise. Just give your new employer your Australian Ethical Super details. Keeping your super in one place makes it easier to track your balance and helps you avoid paying multiple fees.

Every ethical super account can help shape the future. When you choose ethical investing, your money supports companies and projects that are building cleaner, fairer communities. Over time, that means your super can contribute to real progress and help create positive change for the next generation. And while you’re making a difference today, you’re also building for tomorrow. Ethical super isn’t just about supporting a better future - it’s about helping you grow a sustainable retirement fund. So you can enjoy the future you’ve worked hard for, knowing your money made a positive mark along the way.