How we invest ethically

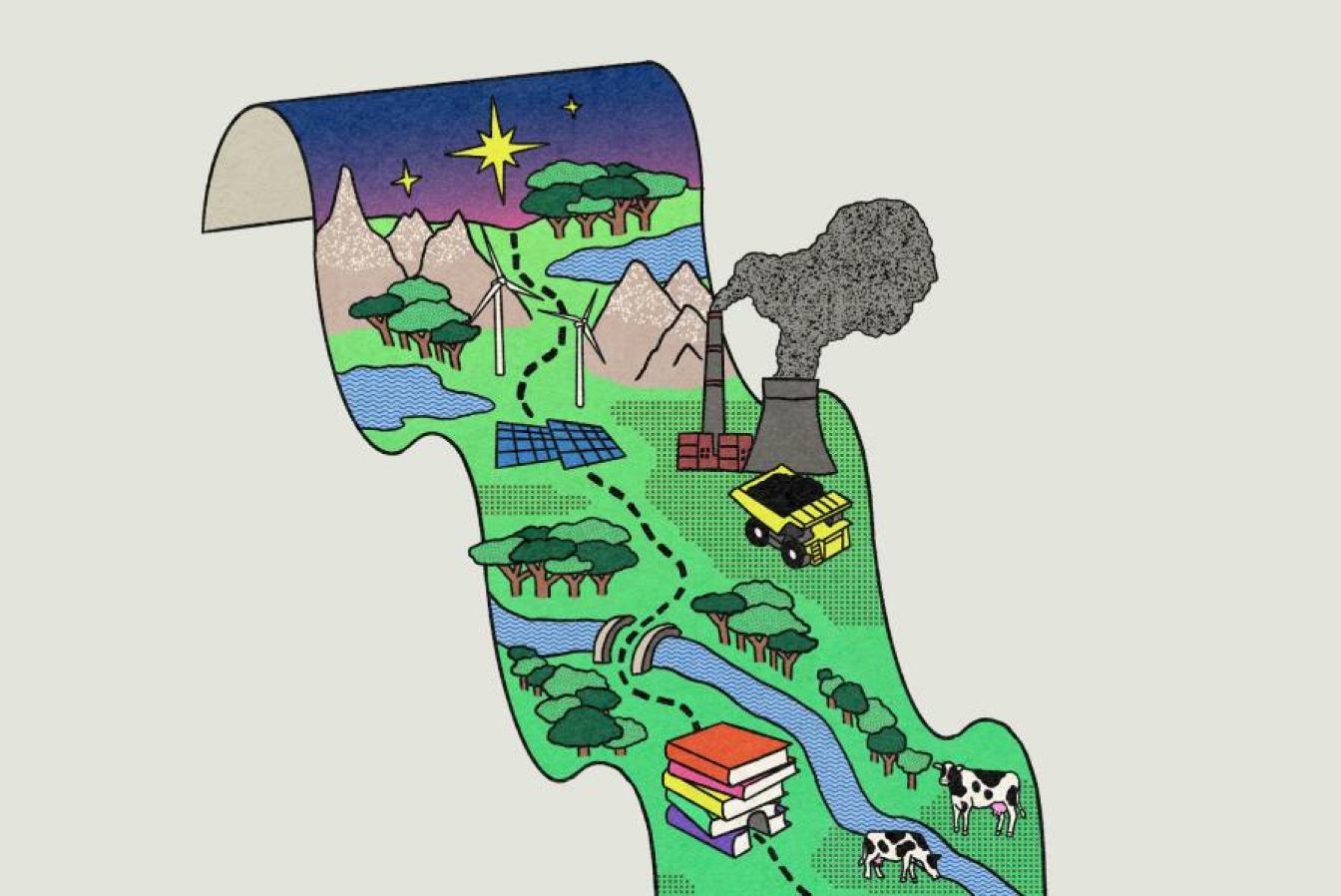

We restrict+ investments in negative activities like fossil fuels, nuclear, tobacco, and support positive ones in renewables, healthcare, IT and more. Step by step, our expert in-house ethics team applies our Ethical Criteria to navigate complex ethical issues raised by investments across the economy.

Guiding principles and criteria

Potential investments must have some positives

To pass our ethical screen an investment must first be assessed as having positive products, services, or other activities assessed against our Ethical Criteria, such as:

Renewable energy

e.g. production of wind turbines or solar panels

Environmental services

e.g. recycling and water treatment

Healthcare

e.g. treatment of serious disease

Real estate

e.g. sustainable buildings, affordable housing

Sustainable food

e.g. growing or processing plant-based nutrition

Sustainable transport

e.g. ships, rail and public transport

How positive?

We determine if an investment has a mild or strong positive by assessing the gross revenue1 from the positive impact activity against our positive thresholds as detailed on page 14 of our Ethical Guide.

Negative impacts are assessed

If an investment meets our positive requirement but has negative impacts from their products or operations, we assess this against our tolerance thresholds such as revenue1 and other Ethical Criteria.

We also consider how a company conducts its business, evaluating serious misconduct. For example, a company or investment which produces positive products may still be excluded if they are mistreating workers or causing unnecessary pollution.

It’s a comprehensive assessment

We won’t invest in a company making weapons or tobacco products because we have a zero-revenue threshold for these activities.

However, if a large, diverse company is positive in other parts of its business, our tolerance thresholds and criteria allow some negative impacts such as limited revenue from some negative products e.g. alcohol or fossil fuels.

Just as we classify company positives in step 2, we also classify the companies’ negative impacts. Our strongest negative category is AVOID: We won’t invest in any company which has an Avoid negative.

There’s a sample of our revenue1 thresholds and other criteria for Strong and Avoid negatives below.

The balancing act

Does the positive outweigh the negative?

To be considered for investment, a company is required to have positive impacts which are not outweighed by stronger negative impacts, focussing on what we assess as the company’s strongest positive and strongest negative.

| Investable | Investable | |

| Investable | Investable | |

| Not investable | Investable | |

| Not investable | Not investable |

Examples of negative thresholds and criteria

Here is a sample of these and some other Ethical Criteria – these are based on our exclusion policies, assessments and investments as of 31 August 2023. The criteria and thresholds can change over time.

There are limited cases when we may hold investments which are not consistent with our Ethical Criteria.

- A business may change after we invest, or we may become aware of new information about the company or issuer which was not identified in our previous research;

- If we are transitioning portfolios as a result of fund mergers or similar transactions, it may take time for us to align with our Ethical Charter, especially illiquid non-aligned investments;

- Investments in companies which meet our Ethical Criteria overall, but our criteria permit some level of tolerance or threshold;

- Cash held with or through custodians or sub-custodians may be held with financial institutions which have not been ethically approved for investment; and

- For externally managed investments, where the external manager makes an investment that is inconsistent with our Ethical Criteria, we consider this a non-compliant investment. To help safeguard against this, we ethically review the investment strategy and responsible investment process of external investment managers to assess consistency with our Ethical Criteria. This includes ongoing periodic review of external managers and their investments. However, because we do not directly manage externally managed investments, there is a higher risk of non-compliant investments being included.

We do not invest in the company if it is:

- Mild positive but >5% revenue in alcohol production OR

- Strong positive but >10% revenue in alcohol production

Examples:

Brewers, distillers and wine makers are excluded where tolerance thresholds exceeded.

We do not invest in the company if it is conducting or commissioning animal testing for cosmetic products (0% tolerance threshold).

Testing for healthcare must adhere to the 3Rs (replacement, reduction, refinement of animal testing).

Examples:

We exclude companies relying on animals in their development of cosmetics and cosmetic products including teeth whitening products.

We invest in biotech and healthcare companies which rely on animal testing for development of new medicines and treatments, provided they are implementing the 3Rs.

Coal

We do not invest in the company if it is:

- Mild positive but has >5% revenue from coal mining or power generation OR

- Strong positive but has >10% revenue from coal mining or power generation

Oil

We do not invest in the company if it is:

- Mild positive but has >10% revenue from oil extraction or power generation OR

- Strong positive but has >33% revenue from oil extraction or power generation

Gas

We do not invest in the company if it is:

- Mild positive but has >10% revenue from unconventional gas extraction OR

- Strong positive but has >33% revenue from gas extraction or power generation

Examples:

We exclude companies like Woodside, Whitehaven Coal, Santos, Origin and AGL because of their fossil fuel revenue.

Contact Energy has some revenue from gas but has passed our ethical screening. It generates over 85% of its electricity from renewables, continues to invest in new geothermal, and relies on gas when low rainfall reduces its hydropower.

We exclude banks who are not taking action to align their institutional lending with the objectives of the Paris Climate Agreement.

We don’t currently invest in any airlines or conventional auto companies, but we could invest if they were investing sufficiently in electric or other renewable energy sources to transition their business to net zero.

Examples:

We invest in electric vehicle companies like Tesla as well as rail and bus companies like Stagecoach Group which have lower emissions and reduce congestion and other pollutants.

We do not invest in the company if:

- It has > 10% revenue from food production from conventional animal agriculture, regardless of whether it is a mild or strong positive OR

- It is Mild positive but has > 15% revenue from food processing from conventional animal agriculture ingredients OR

- It is Strong positive but has > 33% revenue from food processing from conventional animal agriculture ingredients OR

- It is Mild positive but has > 50% revenue from other types of non-sustainable food such as junk food

Food is assessed as sustainable if it is (1) part of a healthy diet; and (2) produced in a way which avoids unnecessary harm to people, animals and environment.

Examples:

These thresholds apply to food producers and processors, not to retailers like supermarkets.

We assess processed food with low nutrient and high salt, trans-fat or sugar content as non-sustainable. We excluded Retail Food Group for its revenue from unhealthy food brands like DonutKing. We excluded Darling Ingredients for its animal food business lines and misleading information about the emissions footprint of animal protein consumption.

We have been strong advocates for an end to live export through our corporate engagement, government submissions and public voice.

We do not invest in the company if it is:

- Mild positive but has > 5% revenue from running a gambling business or making gambling machines OR

- Strong positive but has > 10% revenue from running a gambling business or making gambling machines

Examples:

We exclude Tabcorp, Aristocrat and Endeavour Group.

Our human rights research focuses on companies with high human-rights-risk products, services and locations, such as fashion companies with factories in high-risk countries. We exclude companies if we identify systemic disregard for adverse human rights impacts.

The supply chains of many companies in our portfolios still raise human rights concerns. Sadly, human rights breaches including modern slavery occur somewhere in the supply chains of most companies. We don’t exclude companies automatically because of human rights breaches because we believe companies have the potential to contribute to better protection of human rights by taking steps to help identify breaches and then to play their role in helping achieve remedy of breaches and action to safeguard against their recurrence.

Examples:

We have excluded several clothing companies because of human rights concerns. We divested from wind power companies Siemens Gamesa Renewable Energy and Xjinjiang Goldwind when we didn’t see enough action to safeguard against involvement in human rights breaches.

We do not invest in the company (0% tolerance threshold).

Examples:

One of the reasons we exclude BHP Billiton is its uranium mining. We don’t exclude investment in nuclear medicine for diagnosis and therapy in healthcare.

We do not invest in the company if it has > 5% revenue from pornography production or distribution.

Examples:

In general, large, listed companies involved in pornography are media companies which earn revenue from distribution of “adult entertainment” below our exclusion threshold. Examples are AT&T Inc (who we invest in because their adult entertainment value is below 5%), and Amazon (where this revenue is below 5%, but we exclude for other reasons).

We exclude companies who log old growth forest except for conservation, fire risk or other acceptable forest management purposes.

Examples:

We excluded SCA (Svenska Cellulosa) for concerns about its old growth forest management.

We may invest in sustainable plantation timber production.

We do not automatically exclude a real estate investment or company that uses some non-certified timber, because we consider the availability of certified timber and the positive and negative impacts of a company’s business.

We do not invest in the company (0% tolerance threshold).

Examples:

We exclude cigarette makers and tobacco growers. We may invest in supermarkets which sell tobacco alongside other products.

We do not invest if any revenue is from production of whole military weapons or lethal firearms (0% tolerance threshold).

Where the company is involved in production of critical components of these weapons which are developed and sold for this purpose, we exclude investments if the company is:

- Mild positive but has > 1% revenue from production of weapons components OR

- Strong positive but has > 5% revenue from production of weapons components

These thresholds apply to companies. When we are considering investing in government bonds, we consider the extent to which the country uses its military to aggressively promote its national interest; and the extent of military influence in the government of the country.

Examples:

We exclude Lockheed Martin and Honeywell International. Weapons excluded include both conventional and controversial military weapons, as well as lethal firearms.

Dig deeper

Different thresholds are specified for some exclusions (e.g. 5% and 10%) where exclusion depends on the other activities of the company. For example, a company which earns revenue from production of alcohol will be excluded in the following cases:

-

Alcohol revenue is more than 5% of total revenue, where the company generates what we assess as a Mild counter-balancing positive impact from its other activities. For example, a company is assessed as producing a Mild positive if it earns the balance of its revenue from producing sustainable food; or

-

Alcohol revenue is over 10%, of total revenue, where the company generates a Strong counter-balancing positive impact from its other activities. For example, a company is assessed as producing a Strong positive if it earns the balance of its revenue from producing sustainable food, and the company is also assessed to be making a significant additional contribution to food security, affordability or sustainability.

We may invest in specific securities issued by a company which support positive impact, even though we have excluded the company for other reasons. For example, ‘green bonds’ and ‘climate bonds’ are designed to fund positive environmental or climate projects focused on issues like energy efficiency, recycling and waste reduction.

After an initial ethical assessment and investment, we conduct periodic ethical reviews of investments. Reviews generally occur every two years although timing may be extended, for example to facilitate review of similar companies at the same time; where material new information is pending; or where there is no evidence of material changes affecting the company.

Reviews may also be triggered by significant changes in a company’s business or practices, discovery of information previously unknown to us or by a change to our assessment of the impact of relevant products, services and business practices. These reviews typically arise as and when we become aware of changes or new information. For example, we become aware of an announcement of a major acquisition by a company, which will change its business mix.

If we assess that an investment is no longer consistent with our Ethical Criteria, we may divest (i.e., sell our investment), or we may choose to engage to attempt to address the issue. If that engagement is unsuccessful, we will then proceed with divestment. Once the ethical decision to divest is made, we proceed to sell the investment in accordance with a prudent investment process. The sale period depends on factors like the size and liquidity of the investment and impact on the relevant funds and portfolios. For example, sales of shares in large, listed companies may be completed in a matter of days, while sales of unlisted investments may take up to a year or more to secure a sale for fair market value. There are no fixed maximum periods for the sale process or for engagement with companies to address issues.

Australian Ethical’s investment process has two parts:

- Our ethics team applies our Ethical Criteria to potential investments, and that research defines our universe of potential ethical investments.

- From those potential ethical investments our investment team constructs portfolios suitable for the investment strategies and objectives of our funds and options.

We expect our Ethical Criteria will define an ethical investment universe broad enough to allow the construction of well diversified portfolios suitable for our investment objectives. If future ethical constraints create unacceptable investment challenges, we can evolve our Ethical Criteria and approach to continue to ensure we’re always pursuing the objectives of the Ethical Charter alongside investment objectives.

For our ethical research, our team draws on third party information and analysis from company, industry, government, ESG research, academic and civil society sources. Often judgement and estimates are necessary to deal with information gaps, unreliability and complexity.

For externally managed investments, our ethical assessment takes into account the external manager’s investment strategy and research process. For example, we invest in the Main Sequence CSIRO Innovation Fund 2 which is an early stage business investment fund focussed on five themes: Humanity Scale Healthcare, Feeding 10B People, Exponential Machines, New Society, Space, and New Transport. We assess our investment in this fund as aligned with our Ethical Charter and criteria because these five themes involve innovation with great potential to reduce suffering and enhance well-being of people and animals.

A company may facilitate negative products and activities of other companies if it provides supporting products and services, such as finance, insurance, transport, professional services and information and other technologies. While the revenue thresholds described above do not apply to supporting products and services, we will in some cases exclude companies because of their facilitation of negative products and activities. For example, we may invest in companies which transport a diverse mix of freight but we exclude transport businesses which specialise in the transport of fossil fuels.

For our tolerance thresholds we generally use revenue as our measure of the relative impact a company is having on the world through its different activities. To assess the revenue breakdown of a company, we will generally use the accounting revenue reported by the company in its financial statements and other reporting. However, in some cases it may be appropriate to use other measures of the mix of a company’s business. For example, an early stage research company may earn little or no revenue, in which case we may look at the breakdown of the company’s research expenditure between the different products it is looking to develop. For a real estate fund or company which has both positive and negative properties, we may look at the breakdown of the value of its property portfolio.

Invest with heart

Join now- We generally use gross revenue as an indicator of how much a company or an issuer is involved in a particular positive or negative activity – and that’s how we present the examples below. However, where we think gross revenue isn’t representative of current and projected business activity or impact, we may consider other indicators. For example, for a biotech research company or company developing transformational technologies, we may consider the valuation of assets or projected revenue, or we may analyse the breakdown of its expenditure.