Browse FAQs by topic

This FAQ page is for Australian Ethical Super & Pension members (member/account number starts with '1' or ‘7’).

Note that some functionalities of the member portal are temporarily unavailable as we undergo an admin transition.

Former Christian Super members (member/account number starts with ‘3’ or ‘4’) please view FAQs here.

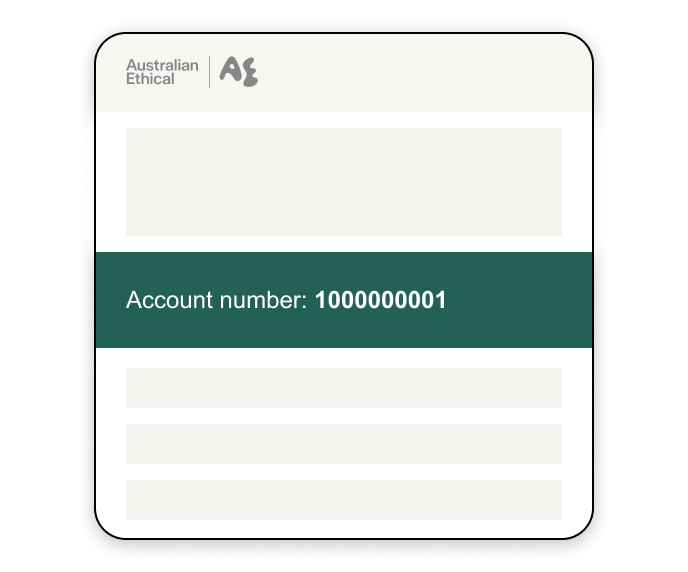

What is my account number?

You can find your Account Number in any recent email from Australian Ethical.

The Account Number is either a:

- 10 digit number starting with '1', or

- 9 digit number starting with '7

If you have not logged in to the member portal before, you can use this to activate it.

If you have super and pension accounts, using either Account Number will work.

Has my membership number changed?

Your current Member Number and Account Number haven’t changed, however our new administrator uses your Account Number as your identifier, instead of your Member Number.

You can activate your member portal by going to the log in page on our website. Click on ‘Activate new portal login’ and follow the prompts. You will need your account number and access to your email and mobile phone to complete the activation process. You can find your Account Number, which is 10 digits starting with '1', in your Annual Statement, or any recent email from Australian Ethical Super.

Your current Member Number and Account Number haven’t changed, however our new administrator uses your Account Number as your identifier, instead of your Member Number. You can find your Account Number, which is 10 digits starting with '1', in your Annual Statement, or any recent email from Australian Ethical Super.

When requesting the code, please type in your email address and mobile number. Do not use the pre-filled information from your password manager or browser autofill.

Email code:

- Check your email junk folder

SMS code:

- Include the '0' in your mobile number. It should be +6104XXXXXXXX, not +614XXXXXXXX.

- Please check your iPhone’s spam filter by opening the Messages app, clicking ‘Filters,’ and then selecting ‘Unknown Senders’. You will only see these ‘Filters’ if you have this option turned on.

If none of the above work:

- Clear your cache

- Try incognito mode

- Try with another device or internet connection

If you didn't finish activating your member portal, go to 'login' and follow the prompts. You should pick up where you left off.

If the password entered isn't working, please click “Reset password”.

You only need one member portal account. All of your Australian Ethical Super and Pension accounts will now be linked.

Two Factor Authentication is a new security feature we've added to our member portal to keep your information safe. This requires two forms of identification.

You can change your email address in your member portal.

- Login then go to your initials in the top right.

- Click on 'Contact details'

- Click on 'Email'

- Enter your email address then click 'Next’

- You’ll receive a verification code via your mobile to confirm the change.

You can change your mobile number in your member portal.

- Login then go to your initials in the top right.

- Click on 'Contact details'

- Click on 'Mobile'

- Enter your mobile number then click 'Next’

- You’ll receive a verification code via your mobile to confirm the change.

You can change your name or date of birth by submitting the Change of Name or Date of Birth form in your member portal.

- Login then go to your initials in the top right.

- Click on ‘Personal details’

- Click on 'Download form’

- The completed form can be uploaded into your member portal or sent to the address of the form via post.

You will need to set a new password as part of the activation process. You can choose any secure password, as long as it meets the set requirements.

You can estimate how much you may have at retirement by following the directions on our website.

The amount of super you need when you retire depends on many things, from how long you live to the type of lifestyle you’d like to have in your retirement.

To learn more, read our articles about how much super should I have in my 30s, in my 40s or in my 50s.

Investment options, risk & return

Members can switch between our investment options at any time. You can do this by logging in to your member portal and navigating to Investments in the menu.

- Login then go to ‘Investments’

- Find ‘Change investments’

Generally, investment switches processed on a Business Day will be processed using the next Business Day’s unit price.

We don’t charge a switching fee but you do need to consider the Buy-Sell spread which is applied to the unit price to calculate the Buy and Sell unit prices which are used in processing a switch.

When processing a switch, the Sell unit price is used in selling units in one investment option and the Buy unit price is used in buying units in the new investment option.

The buy–sell spread is a fee to recover transaction costs incurred in relation to the purchase and sale of assets of the Fund and is used to adjust the unit price. It is an additional cost to you and is incurred when you contribute, transfer or redeem. We will use a buy–sell spread to recover transaction costs from you so that other investors are not paying for the cost of your transaction. It is not a fee paid to us.

An estimated buy-sell spread cost is $10 to $250 for balances between $20k to $100k. There is no additional switching fee.

More information on our Buy-Sell spreads is available on our fees page.

- Check our investment fees before you make any changes as the investment options have different fee amounts

- Consider if you're comfortable with the amount of risk associated with your investment options.

Investment risks, returns and advice

A return is a loss or gain on your investment which is usually expressed as a percentage. Our investment option returns are visible through the daily unit prices and are reported on a monthly basis on our website. A dollar return for your account is also provided on your member portal in the Account summary section on the Dashboard.

NOTE: Our reported performance does not include your account administration fee, or any insurance premiums paid through your account.

Return of capital and the performance of your investment in the fund are not guaranteed. You should also remember that past performance is not a reliable indicator of future performance.

Investments that generate higher returns also tend to have higher levels of risk (often referred to as volatility).

Investments that carry less risk usually provide smaller, more stable returns but may not perform strong enough for you to save as much as you need for the future and typically doesn’t grow higher than the rate of inflation.

Different investments come with different levels of risk so it comes down to choosing the investments that align with your goals, stage of life and risk profile.

We recommend speaking to a financial adviser to better understand which investment options are right for you at your different stages of life.

More information about the risk and return characteristics of our investment options can be found in the Product Disclosure Statement and Additional Information Booklet.

Yes. You can choose just one investment option or spread your super balance across a mix of our seven investment options.

If you’re a new member you’ll be asked to select whether you’d like to choose your investment option(s) or be placed in our default option which is the ‘Balanced (Accumulation)’ option in the join form.

Members can switch between our investment options at any time. You can do this by logging in to your member portal and navigating to Investments in the menu.

- Login then go to ‘Investments’

- Find ‘Change investments’

Generally, investment switches processed on a Business Day will be processed using the next Business Day’s unit price.

Please note when you change your investment option(s) you will incur a buy/sell spread fee.

An asset is something you invest in, such as property, shares, bonds or cash. A group of property investments form an asset class, and so do a group of shares. Assets usually fall into two main categories: defensive and growth.

Defensive assets are typically less risky and generally provide more stable returns over the short term but tend to produce lower returns over the long run. Cash and Fixed Interest are examples of defensive assets.

Growth assets are typically higher risk and provide more volatile returns in the short term but tend to produce higher returns over the long term. Shares and property are examples of growth assets.

We’re not able to provide you with personal financial advice but our team can provide you with general information on topics such as salary sacrificing, understanding our investment options, and the insurance options we offer.

We recommend you speak with a licensed adviser before you make any financial decisions.

If you are looking for an ethical adviser, you can find one in your area by using the Find an Adviser tool through the Responsible Investment Association Australasia (RIAA).

Investment performance and unit prices

A unit price represents the value of each unit in an investment option. The unit price for each investment option is calculated by dividing the value of the assets in the option (after allowing for fees, costs and taxes) by the number of units on issue.

As the value of these assets and liabilities can go up or down and is dependent on market valuation, the unit prices for the different investment options also can go up or down.

Transactions occur using the ‘Buy’ and ‘Sell’ unit prices. These are calculated by applying the Buy-Sell spread to the unit price (Net Asset Value).

Additional investments, including all forms of contributions are processed using the ‘Buy’ unit price. When exiting an investment option, or the fund, the ‘Sell’ unit price is applied to your transaction.

When you invest in any Australian Ethical Super investment option your money is placed in a pool of assets, along with every other member that has chosen that investment option. When the investment options are valued, a price is determined for the interest (or units) in that option.

When you make a contribution, switch your investment option or change your mix of investment options, or roll out your funds, you are in effect buying and selling units.

Each investment option is divided into units and every unit you own in that investment pool represents your share of that investment option.

The initial units allocated to you are determined by your account balance divided by the unit price for the investment option/s that you invest in.

For example: If you invested $100,000 in the Balanced (accumulation) option on 31 December 2018, you would have been allocated with 100,000 units.

This is based on a ‘Buy’ unit price of $1 per unit and calculated as $100,000 / $1.00 = 100,000 units.

Investment performance

Our investment option returns are reported on a monthly basis on our website. A dollar return for your account is also provided on your member portal in the Account summary section on the Dashboard.

NOTE: Our reported performance does not include your account administration fee, or any insurance premiums paid through your account.

Unit prices

We calculate and issue unit prices every NSW business day. A national business day is any day that is not a weekend or NSW public holiday. You can view and download daily unit prices here.

Return of capital and the performance of your investment in the fund are not guaranteed. You should also remember that past performance is not a reliable indicator of future performance.

It takes up to two business days to calculate the unit price. During these two days, we calculate the value of all the assets we invest in and the number of units on issue, which is affected by contributions and withdrawals.

We need these valuations to accurately calculate the unit price for any of our investment options.

To find out more about how unit prices are calculated and used, please see our legal disclaimer.

The performance data is updated on a monthly basis.

Annualised investment returns in % are calculated:

- Using the exit price

- Net of administration and investment management fees, taxes and other costs (which means these have been deducted)

- The standard calculations are based on a member with an account balance of $50,000, which will not be relevant to all members

- The standard calculations do not allow, for example, for the effect of contributions to your account, insurance fees or various other matters

- Performance figures relating to unit prices between 1 July 2011 and 31 December 2016 have been restated following the remediation of a unit pricing error

- Figures showing a period of less than one year have not been adjusted to show an annual total return. Figures for periods of greater than one year are on a per annum compound basis.

Investment returns in $ are calculated:

- On a monthly basis

- Using the exit price

- Net of %-based administration and investment management fees and taxes (which means these have been deducted)

- Gross of $-based member fee (which means these have not been deducted)

- The standard calculations do not allow, for example, for the effect of contributions to your account, insurance fees or various other matters

Return of capital and the performance of your investment in the fund are not guaranteed. Past performance is not a reliable indicator of future performance.

When we use the term “healthy” we are referring to the fact that our ethical approach applies to every investment we make and where the product or option has delivered after fee returns in the top 2 quartiles amongst its peer group over the relevant investment period.

When we use the term “strong” we are referring to the fact that our ethical approach applies to every investment we make and where the product or option has delivered after fee returns in the top quartile amongst its investment peer group over the relevant investment period.

Fees

Fees vary depending on things like your account balance and your chosen investment option/s.

To understand our fees better, visit our fee information page.

We don’t charge a switching fee but you do need to consider the Buy-Sell spread which is applied to the unit price to calculate the Buy and Sell unit prices which are used in processing a switch.

When processing a switch, the Sell unit price is used in selling units in one investment option and the Buy unit price is used in buying units in the new investment option.

The buy–sell spread is a fee to recover transaction costs incurred in relation to the purchase and sale of assets of the Fund and is used to adjust the unit price. It is an additional cost to you and is incurred when you contribute, transfer or redeem. We will use a buy–sell spread to recover transaction costs from you so that other investors are not paying for the cost of your transaction. It is not a fee paid to us.

An estimated buy-sell spread cost is $10 to $250 for balances between $20k to $100k. There is no additional switching fee.

More information on our Buy-Sell spreads is available on our fees page.

You can confirm that your large account fee discount has been applied in your member portal.

- Login and then go to ‘Transactions’

- Find a transaction labeled ‘admin fee rebate’, which shows the gross amount of the discount.

Your current Member Number and Account Number haven’t changed, however our new administrator uses your Account Number as your identifier, instead of your Member Number. You can find your Account Number, which is 10 digits starting with '1', in your Annual Statement, or any recent email from Australian Ethical Super.

You can change your email address in your member portal.

- Login then go to your initials in the top right.

- Click on 'Contact details'

- Click on 'Email'

- Enter your email address then click 'Next’

- You’ll receive a verification code via your mobile to confirm the change.

You can change your mobile number in your member portal.

- Login then go to your initials in the top right.

- Click on 'Contact details'

- Click on 'Mobile'

- Enter your mobile number then click 'Next’

- You’ll receive a verification code via your mobile to confirm the change.

You can change your name or date of birth by submitting the Change of Name or Date of Birth form in your member portal.

- Login then go to your initials in the top right.

- Click on 'Personal details'

- Click on 'Download form’

The completed form can be uploaded into your member portal or sent to the address on the form via post.

Yes, Australian Ethical Super provides you with three death beneficiary options for your account. Some important legal considerations are outlined below.

- Binding death nominations – You have the choice to determine who should receive your death benefit as long as the people you nominate are classified as a dependant under superannuation law. You can complete the Binding death benefit nomination form to nominate your beneficiary. Please note you need to update your binding nomination every 3 years for it to remain valid.

- Non-binding death nominations – As this nomination is not binding, the Trustee has the discretion to pay your money to one or more of your dependants or your legal personal representative (i.e. the executor of your estate). You can make a preferred nomination in the member portal by going to the ‘More’ dropdown menu > ‘Beneficiaries.

- No death benefit nomination – your benefit will be paid at the discretion of the Trustee to one or more of your dependants and/or legal personal representative.

It's best to read the Product Disclosure Statement to understand everything you need to know about death benefit nominations. Regardless of which option you choose, the Trustee must ensure that your money is paid to your dependants or legal personal representative.

You can change your non-binding beneficiaries in your member portal.

- Login, and click on 'more' in the top right

- Click on 'Beneficiaries'

- Follow the instructions.

To change binding beneficiary nominations in your member portal:

- Login, and click on 'more' in the top right

- Click on 'Beneficiaries'

- Click on 'Download form' in the 'Nominate binding beneficiaries' tile on the right hand side.

The form can also be found online here. You can upload this form to to your member portal via the 'Send us an enquiry or document' feature in the 'We're here to help' tile.

You can also send the form via post to the address on the form.

You can change your chosen bank account by completing the 'Pension Change of Details' form.

You can upload the form to your member portal.

- Login, then go to ‘Send us an enquiry or document’

You can also post the completed form to the address listed on the form.

You will be required to provide a recent copy of your bank statement to verify the new account.

Transactions

A 'download' feature for transactions is currently under development. Until this is available, you can call us (AE) on 1800 021 227 8.30am to 5.30pm AEST/ ADST Mon-Fri or email us at members@australianethical.com.au.

Super Guarantee contributions by employer

We are currently developing the ability to view your employer name for super guarantee contributions. Until this is available, you can call us (AE) on 1800 021 227 8.30am to 5.30pm AEST/ ADST Mon-Fri or email us at members@australianethical.com.au.

You can keep your super with us when start your new job. All you need to do is complete the Choice of Fund Form, give it to your new employer and they can start putting your super contributions into your Australian Ethical Super account.

Additional contributions

You can join online and roll your super over combine your super (rollover) during the join process. We’ll search for your existing super with the Australian Tax Office (ATO) using 2 forms of Australian government ID and your Tax File Number (TFN).

You can review the search results to decide how much to transfer.

Then sit back & relax, we’ll do the rest and inform you when it’s done, often after 7 - 10 business days.

If you are self-employed, you can find your BPay details for contributions in your member portal.

- Login then go to ‘Transactions’

- Go to ‘Make a contributions’

- Your BPay details will be displayed

You can make personal contributions any time. They’re called non-concessional contributions because they’re made from your salary after income tax has been deducted. These are subject to contribution caps which are explained in the FAQ below.

To make a contribution via BPAY® you’ll need your Australian Ethical Super BPAY® Customer Reference Number (CRN) and our BPAY® Biller Code.

These details are available by logging into your online account in the ‘Personal details’ section (scroll to the bottom of the page) or call us on 1800 021 227 8:30am to 5:30pm (AEST), Monday - Friday.

If you’re making a payment through BPAY®, it can take us up to two business days to receive it. This also depends on your financial institution’s processing times.

You may be eligible for co-contributions from the Government on different types of personal contributions. Refer to the ATO website for more information.

Note: You can also claim a tax deduction on certain personal contributions which means your contribution is no longer ‘after tax’. These then count towards your concessional contributions cap for the year.

By submitting a Notice of intention to claim a tax deduction for personal super contributions to the Fund, you can have some or all your after-tax contributions treated as before-tax contributions.

If you’re considering making contributions in this way, we recommend professional tax advice as limits and other conditions may apply. For more information about making additional contributions, visit the ATO website.

Yes, you can make additional before-tax contributions to your super. In addition to making the required superannuation guarantee contributions to your nominated super fund, your employer may be able to support salary sacrifice arrangements.

Under this arrangement, your employer deducts a specified amount from your pay (before it gets taxed) and sends it to your nominated super account. These contributions will also count as concessional contributions and limits apply.

You can also learn more here.

Contribution limits or ‘caps’ are set by the Government and differ depending whether you’re making non-concessional (after-tax) or concessional (before-tax) contributions. If you do make contributions that exceed the cap, you may have to pay additional tax, and excess concessional contributions may also be counted towards your non-concessional cap.

Your ability to make certain types of contributions may be affected by your total super balance (for example, the total amount you have in super and/or pension accounts at 30 June of the previous financial year.)

For more information on your contribution limits and what they might mean for you, visit the ATO website.

To receive a spouse contribution into your Australian Ethical Super account, you’ll need to provide your spouse with your Australian Ethical Super BPAY® Customer Reference Number (CRN) and our BPAY® Biller Code.

NOTE: Your BPAY biller code for spousal contributions is different to your personal contribution’s biller code. These details are available by logging into your super account and clicking on Transactions in the menu > Make a contribution, or contacting us on 1800 021 227.

If your spouse’s income is below a level set by the ATO, and eligibility conditions are met, you may be able to make spousal contributions to your spouse’s super account which receive a tax offset.

Information on income levels, eligibility requirements and the level of tax offsets can be found on the ATO website.

NOTE: This doesn’t mean splitting your own contributions between your spouse and yourself. For information on contribution splitting please visit refer to the Additional Information Booklet.

For the purposes of superannuation, a 'spouse' means another person (of any sex) who:

-

you’re in a relationship with that is registered under a prescribed state or territory law, or who

-

although not legally married to you, lives with you on a genuine domestic basis in a relationship as a couple.

You can find your BPay details for contributions in your member portal.

- Login then go to ‘Transactions’

- Go to ‘Make a contributions’

- Your BPay details will be displayed

Tax

Tax rules can be complex, and subject to change. Understanding how tax and super work can help you make the most of any tax advantages available to you and help you avoid costly mistakes.

Generally, the points at which your super could be taxed are:

-

When it goes into your Australian Ethical account (contributions)

-

If you are eligible, when your super is withdrawn under the age of 60 (super benefits)

This is a summary only and is subject to change.

All employer contributions, as well as any personal contributions for which a tax deduction is claimed, are usually taxed at a rate of 15%.

Personal contributions and spouse contributions are not usually taxed, as these contributions are made after you have already paid income tax.

If you exceed the contribution limits set by the Government, then you may need to pay more tax on your contributions.

How these tax rules affect your individual super situation is something you should discuss with a financial adviser or the ATO. For further information, visit our Additional information booklet.

Combine super

Visit the Combine super page for an overview.

There could be benefits to combining your other super with your Australian Ethical Super account:

- Our portfolio is 75% less carbon intensive: The carbon intensity (tonnes of CO2 equivalent per dollar company revenue) for our listed share investments at 30 June 2024 is 75% lower than a mainstream share market benchmark(1,2)

- You could save on fees

- Easier to keep track: Less paperwork and track your super balance more easily.

Click here to learn more about combining your super.

If you are already a member:

You can combine your super in your member portal.

- Login then go to ‘Combine super’ in the ‘Your to do list’

- OR go to ‘More’ then ‘Combine Super’

- OR fill in our super rollover form and upload it to your member portal

Alternatively, you can request to combine your super:

- in your myGov account

- OR by calling and informing us of your previous fund name(s) and member/account number(s)

If you are not a member yet:

You can join online and roll your super over combine your super (rollover) during the join process. We’ll search for your existing super with the Australian Tax Office (ATO) using 2 forms of Australian government ID and your Tax File Number (TFN).

You can review the search results to decide how much to transfer.

Then sit back & relax, we’ll do the rest and inform you when it’s done, often after 7 - 10 business days.

If you have any questions, please call us on 1800 021 227 8:30am to 5:30pm (AEST), Monday - Friday.

You can combine your super funds through your member portal, by filling in our super rollover form and uploading it via your member portal or by calling 1800 021 227.

- Consider Insurance

If you have insurance with another fund, you may lose your cover when you rollover all your funds to Australian Ethical Super. Consider that you can either:

– Keep your existing fund’s cover; OR

– Transfer insurance cover after you join

You may be eligible to transfer the insurance cover you have with your other fund over to us using the Transfer of insurance cover form.

Please refer to the Insurance Guide or call us for more information. - Check with your employer

Check whether combining your super will affect how much your employer contributes. - Make an informed decision

Please read the Product Disclosure Statement and Target Market Determination before making a decision. We recommend you seek professional advice from a licensed financial adviser. This is particularly important if you're in a defined benefit fund. - You might not be able to transfer some of your super

Certain funds, such as some government funds, have rules that do not allow you to transfer your super to another fund. If your request to transfer your super is rejected by your other fund, we will let you know.

The benefits of providing your tax file number (TFN) are:

- Australian Ethical will be able to accept all permitted types of contributions to your account(s).

- You will not pay more tax than you need to. This affects both contributions to your super and benefit payments when you start drawing down your super benefits.

- It will make it much easier to find different super accounts in your name so that you receive all your super benefits when you retire.

- Australian Ethical will be able to use the ATO SuperTICK service to verify your TFN, name and date of birth.

Australian Ethical Super is authorised by law to ask for your TFN.

Providing your TFN will make sure you won't pay more tax than you need to. There are other benefits of providing your TFN.

When we have your TFN, we will only use it for lawful purposes based on current legislation. We may pass your TFN to any other super fund or account to which your super is transferred in the future, unless you request in writing that this is not to be done.

Once you have provided your consent above, it will remain effective until such time as you advise us to remove it. To remove consent please contact us on 1800 021 227 Monday to Friday 8.30am to 5.30pm AEST/AEDT.

First you need to make sure you have an account with us. You can do this by joining online. During the limited service period, we will securely hold onto your details, update you regularly via email, and process your application as soon as we can. After your application is processed, we will send you your new account details to commence combining funds from your SMSF to your new Australian Ethical superannuation account.

Australian Ethical must use SuperStream to roll over your super benefits. This means your SMSF will need an electronic service address (ESA) and Australian business number (ABN). You can get an ESA from an SMSF messaging provider or through your SMSF intermediary/administrator.

For more information, please refer to the ATO self-managed super fund rollover page.

Insurance through super

Visit the Insurance through super page for an overview.

General questions

Calculating the right level of cover you need can be a challenge. Use our insurance needs calculator to help you work out how much cover you may need – the calculator takes into consideration your lifestyle, age, and financial position.

If you choose to cancel your cover within 90 days of the cover first commencing, the cover will cease from the date the cover started. The full premium amount will be refunded back to your account.

However, if you cancel your cover after 90 days of cover commencing, your cover will turn off on the date you notify us of your cancellation. Any owing premiums will be deducted from your super account at the end of the month.

It’s important to note once you cancel your insurance you won’t be eligible to lodge a claim should you suffer and injury or illness after the cancellation date. Please consider how this may affect your dependants including your spouse, children or anyone who is financially dependent on you.

We understand people’s circumstances change so if you require insurance in the future, you will need to apply for insurance. The acceptance of cover is subject to the insurer’s approval (special terms likes loadings or exclusions may apply). You can apply for insurance by online via the member portal or by competing the Insurance Application Form.

If you’d like to cancel your existing cover, you can do this via the member portal, by contacting us (by phone or email) or by completing the Insurance Variation Form.

Please note if your account is unfunded or you leave the fund, your cover will be cancelled.

To calculate your annual premium, you can multiple the monthly premium that is shown in your insurance summary table by 12.

Example:

- Monthly premium = $33.71 x 12

- Annual premium = $33.71 x 12 $404.52*

*Please note that this example does not take into account any changes that may influence the cost of your insurance cover. For example, if you have a birthday or your amount of cover changes.

You can see the actual insurance premium deducted from your account each month in the 'Transactions' section of your member portal at the top menu. The insurance premium deducted is based on the number of days in the month and days in the financial year (and is deducted in arrears).

Monthly premium deducted = annual premium / days in financial year x days in month

Example: October 2024 premium = $404.52/365 x 31 = $34.36

Default Death and TPD Cover

The cost of Default Cover is calculated as an annual insurance premium using the annual premium rate and occupation loadings. Insurance premiums are deducted from your super account monthly and will vary based on the amount of cover you have under the Default Cover scale, your age, sex at birth, and occupation category. Please refer to our premium rate table in the Insurance Guide.

The cost of Default Cover is calculated as an annual insurance premium using the annual premium rate and occupation loadings. Insurance premiums are deducted from your super account monthly and will vary based on the amount of cover you have under the Default Cover scale, your age, sex at birth, and occupation category. Please refer to our premium rate table in the Insurance Guide.

We offer Default Cover, which consists of a set level of Death & TPD cover depending on your age. As you get older the amount of Death & TPD cover provided to you will change, so will the premiums you pay. Premiums are paid from your super account monthly and the amount you pay depends on your age, occupation and sex at birth.

Default Cover is automatically provided when you are age 25 or older (but under 65) and have had an account balance of $6,000. If you want cover before these conditions are met you can opt in to commence cover at any time via the member portal or by completing an Insurance Opt-in Form.

Please consider the impact insurance has on your retirement savings.

For further details on terms and conditions, please read our Insurance Guide.

If you don’t want Default Cover to commence automatically when you reach the eligibility conditions, you can opt-out of Default Cover when you join the fund. If you’ve already joined the fund and have not met the eligibility criteria, you have the option to opt-out Default Cover before it commences by completing the Insurance Variation Form or you can call us.

It’s important to note once you opt-out of Default Cover, you won’t receive Default Cover in the future. This means you won’t hold insurance cover and won’t be eligible to lodge an insurance claim should you suffer an injury or illness. Please consider how this may affect your dependants including your spouse, children or anyone who is financially dependent on you.

We understand people’s circumstances change so if you require insurance in the future, you will need to apply for insurance. The acceptance of cover is subject to the insurer’s approval (special terms likes loadings or exclusions may apply). You can apply for insurance by online via the member portal or by competing the Insurance Application Form.

Yes – the Default Cover you receive is restricted by new events cover limitations for the first 30 days. New events cover limitations are removed after the first 30 days as long as you meet all of the conditions outlined as outlined in the Insurance Guide, under the heading ‘Are there any restrictions that apply to Default Cover?’

Fixed Death and TPD Cover, Income Protection (IP) Cover

If you would like to fix your Default Cover or nominate a dollar amount of Death & TPD cover you would like to receive without it changing over time*, you can apply for Fixed Cover. Generally, premiums increase as you get older.

If you would like to fix your Default Cover, you can do this by completing the Insurance Variation Form.

If you would like to nominate a dollar amount, you will be subject to medical checks and your cover may be subject to exclusions and loadings. You can apply anytime by completing the paper Insurance Application Form or by logging into the member portal and applying online.

*The level of cover provided under Fixed Cover will remain the same regardless of your age until you reach 61 (subject to maximum insurable age restrictions). From age 61, the level of TPD cover will reduce each year until it reduces to zero at 70.

With our insurance premium calculator, you can see what you'll pay when you increase or decrease your cover.

Note - the costs represent Fixed Cover premiums only.

You can apply for IP anytime by completing the paper Insurance Application form or by logging into the member portal and applying online.

Making an insurance claim

Visit the Making an insurance claim page for step-by-step process on how to make an insurance claim with us.

We understand this may be a difficult time for you and your family and we are happy to help you through this process.

Insurance terms and conditions

If you’re a member of Australian Ethical Super, you can have more than one super account, however you cannot hold more than one insurance policy with us.

If you hold multiple super accounts with other funds, there may be limitations which precludes you from claiming under multiple policies. Please be aware of the terms and conditions of all your insurance policies so you avoid paying insurance fees that you may not be able to claim on. Consider the impact of having multiple policies on your retirement savings.

If you’ve transferred your insurance cover from a complying super fund, and your transfer of cover has been accepted but you continue to hold cover in the previous fund, then any benefit paid to you under insurances held through Australian Ethical Super will be reduced by the amount of insurance cover that you continue to hold elsewhere.

Inactive accounts and Insurance – From 1 July 2019 we’re no longer able to provide insurance cover through your super when your account has been inactive (regardless of your account balance) unless you let us know you’d like to continue to receive insurance.

An account is considered inactive if money hasn’t been paid into your account for a continuous period of 16 months.

You can choose to make a valid election to keep your insurance via the member portal or by completing the Insurance Opt-In Form. You still need to make sure you have enough money in your super to pay for insurance premiums on a monthly basis.

Australian Ethical will pay a death benefit in the event of your death. This benefit includes the balance of your super account and any insurance benefits you may have.

There are a few documents which need to be completed by either your executor, a legal representative or potential beneficiary after your passing. Death Benefits are usually paid to either:

-

your dependants - spouse (including a de facto spouse, children, anyone who is financially dependent on you, or anyone you have an interdependent relationship with); or

-

your Legal personal representative (i.e. the executor of your estate).

If you worked and earned super while visiting Australia on a temporary visa, you may be eligible to withdraw your super funds through the Departing Australia Super Payment (DASP) program.

After leaving Australia, you can claim your super through the online Australian Taxation Office (ATO) DASP online application. If you have any questions about this process, contact us or the ATO.

Main things you need to know:

-

to claim, you must be either a non-resident or on an eligible temporary resident's visa

-

you can't make a claim if you're an Australian citizen, permanent resident or New Zealand citizen

-

claims are made as cash lump sums and can’t be rolled into another overseas fund.

In some circumstances, you may be able to access your super early if you experience the following events:

-

Incapacity – if you suffer permanent incapacity (also called Total and Permanent Disablement (TPD)).

-

Severe financial hardship – if you’ve received Commonwealth benefits for 26 continuous weeks but are still unable to meet immediate living expenses.

-

Compassionate grounds – to pay for medical treatment if you’re seriously ill.

-

Terminal medical condition – if you have a terminal illness or injury which is likely to result in death within 2 years, as certified by two registered medical practitioners (at least one must be a specialist).

For more information about these conditions of release and what evidence you need to submit, you can call us on 1800 021 227, 8:30am to 5:30pm (AEST), Monday-Friday.

It depends how old you are. You may be able to withdraw your super if you’ve reached the appropriate preservation age which is between 55 and 60 depending on when you were born (see below) and have permanently retired. If you haven't permanently retired, you can still access part of your super through a transition to retirement pension.

Apart from permanent retirement and reaching your preservation age, you can access your retirement savings under the following circumstances (one is usually enough):

-

you reach age 65

-

you are permanently retired on or after age 60

-

you have a terminal illness

-

you become totally and permanently disabled/permanently incapacitated

-

you experience severe financial hardship and meet certain requirements

-

you have compassionate grounds for needing the money, as approved by the ATO

-

if you are a temporary resident on a specified class of visa and you permanently depart Australia.

If you have any questions please call us on 1800 021 227, 8:30am to 5:30pm (AEST), Monday - Friday.

Pension account enquiries

Visit the Pension/Retirement page for an overview.

You can start a pension once you have met the eligibility criteria. You can apply by filling in a paper form and posting it to us.

No. Once you’ve opened a pension account you won’t be able to make any additional contributions to this account.

Pension payments are made directly into your nominated bank account. These can be paid bi-monthly, monthly, quarterly, half-yearly or annually and the payment is made on the 15th (and also the 28th for bi-monthly) of every month.

Your nominated account must be held either in your name or if the account is held jointly, you must be one of the account holders. You’ll need to provide a copy of your bank statement at the time you set up your payment.

You can make a partial withdrawal (over and above your pension payments) or a full withdrawal at any time by completing and returning our withdrawal form.

You can also make withdrawals online from your pension account through the member portal.

Note: a minimum of $1,000 and a maximum of $10,000 apply to online withdrawals. One withdrawal is allowed per day, and it takes up to 3 working days to process your online withdrawal request.

Call us on 1800 021 227 if you need more information or you’d like us to send you a copy of our withdrawal form.

You can change your chosen bank account by completing the 'Pension Change of Details' form.

You can upload the form to your member portal.

- Login, then go to ‘Send us an enquiry or document’

You can also post the completed form to the address listed on the form.

You will be required to provide a recent copy of your bank statement to verify the new account.

There are three options:

Proportional: Your pension payments will be drawn proportionately (pro-rata) from the investment options you are invested in.

Percentage: Your pension payments will be drawn from your investment options based on your nominated percentage.

Priority order: You can decide the order in which your investment options will be drawn down for your pension payments. Once the first option is exhausted, your pension payments will be drawn down from your next option and so forth.

Centrelink needs to know some details about your Australian Ethical Pension to calculate payments, such as the age pension.

We communicate this information directly to Centrelink electronically every February and August. Call us to request a Centrelink schedule.

Below is an overview of the minimum drawdown rates.

| Age | Standard Rate |

|---|---|

| Under 65 | 4% |

| 65 to 74 | 5% |

| 75 to 79 | 6% |

| 80 to 84 | 7% |

| 85 to 89 | 9% |

| 90 to 94 | 11% |

| 95 and over | 14% |

Market performance and updated drawdown requirements may prompt you to reconsider your pension strategy. However, it’s important to understand how your money is invested before making any changes. Which is why it can be helpful to speak to a financial adviser.

If you’d like to update your pension payment amount (set a new minimum OR set an amount) you can do so by following these steps:

- Log into your member portal

- Click ‘Pension’ in the menu

- Select ‘Change payment details’

- Update frequency and/or amount of pension payment you require.

Your updated pension payment amount will apply when your next pension payment falls due. If we are due to make your next payment within 10 working days, we may update your payment amount after this payment.

You can also complete a Change of Details form - Pension (available on our website) and upload it to the member portal or mail it back to us.

- Scan and upload your completed form in your member portal under the ‘We’re here to help’ section.

OR

- Post your form back to:

Australian Ethical Superannuation

GPO Box 3117

Brisbane QLD 4001