6 ethical pension options

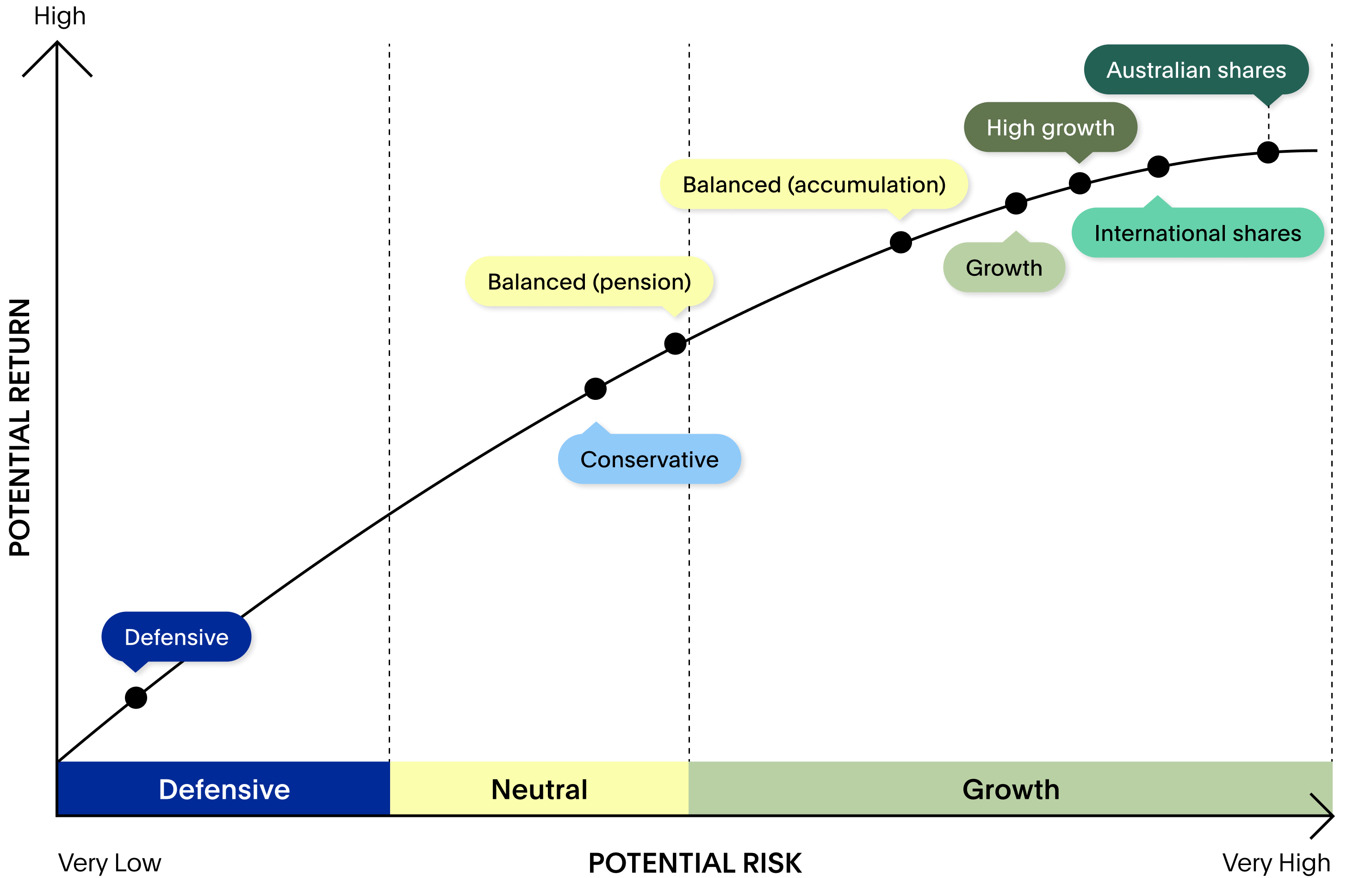

We have six ethical pension investment options ready-made for you to pick from to suit your needs. Each have different risk profiles for you to choose from based on your financial objectives, risk tolerance and personal financial situation.

A full explanation of all the Option features including fees and costs that you may be charged for investing in the Option is provided in the Product Disclosure Statement and the fee information page. For further information about the Option and how we assess investments using our Ethical Criteria, please read the Additional Information Booklet, Target Market Determination and the Ethical Guide.

Defensive: You want to keep your money safe and earn a steady, small return. You’re planning to use your money soon, so you don’t want to take big risks.

Neutral: You’re okay with a bit of up and down, but still want your money to grow slowly over time. You might use it in the medium term, so you want a balance between safety and growth.

Growth: You don’t need the money for a long time, so you’re happy to take more risks to grow your money more. You’re not worried about short-term ups and downs.