Decoding the shades of green

Green is the new black

As more consumers realise that responsible investing can help influence positive change in the world, they are ratcheting up their expectations of financial institutions and advisers. In recent consumer research by RIAA, 84% of respondents said it was important their super fund or bank commits to reducing emissions, with 81% wanting pledges to achieve net zero by 2050.1 Other environmental and social issues were also highlighted, with 83% wanting their investments to protect biodiversity and 81% wanting to protect Indigenous cultural heritage.

Prioritising investment returns was no longer consumers’ number one expectation of their financial adviser. Instead, being knowledgeable about responsible investment came in at number one (64%).1

"Consumers’ number one expectation of financial advisers was that they were knowledgeable about responsible investment (64%)”.

The rise of responsible investing

Asset managers have recognised and responded to the growing demand for responsible investments. They are re-shaping their investment thinking and showcasing green credentials in their marketing campaigns. Indeed, 89% of the investment market are now claiming that they are investing responsibly.2 The reality according to RIAA however, is that only around 40% of the market could be classified as responsibly invested, and within that spectrum only “25% of investment managers in Australia are practising a leading responsible approach.”1

Shades of green

With no formal naming standards, how do advisers and consumers distinguish between the many and varied responsible investment claims and the real deal? What are the shades of green that sit within the definition of responsible investing and how do you distinguish a leading investment approach? We set out some key green categories below, while RIAA provides a helpful search tool here Responsible Returns Tool.

ESG integration

Considering Environmental, Social and Governance-related (ESG) risks and opportunities in the analysis step of the investment process, known as ESG integration, is the most common ‘green’ approach cited by Australia fund managers (57% have at least 85% of AUM covered by ESG integration)2.

“ESG integration is important”, says Dr Stuart Palmer, Head of Ethics Research at Australian Ethical, “but on its own it tends to be ‘ethically passive’. It won’t stop a fund investing in a harmful product if the manager thinks the company’s share price has fallen far enough to represent good financial value. This approach is unlikely to live up to the values alignment demanded by consumers and we would classify this as ‘light green’.”

Negative screening (exclusions)

Another common light green approach is to exclude investing in one or two issues, the most common in Australia being fossil fuels (22%) and tobacco (19%)2. While this growing trend of exclusion is great to see, it’s just the beginning and is not actually meeting the breadth of consumer demand. In 2022, the top two issues consumers wished to avoid in their investments were animal cruelty and human right abuses1. This mismatch is not surprising as the screening of human rights abuses and animal cruelty in investee companies and their supply chains is a nuanced and challenging exercise, requiring careful research, detailed tolerances and activity thresholds and ongoing monitoring. AE has developed our approach over more than three decades and you can read more about it here.

Positive screens (inclusions)

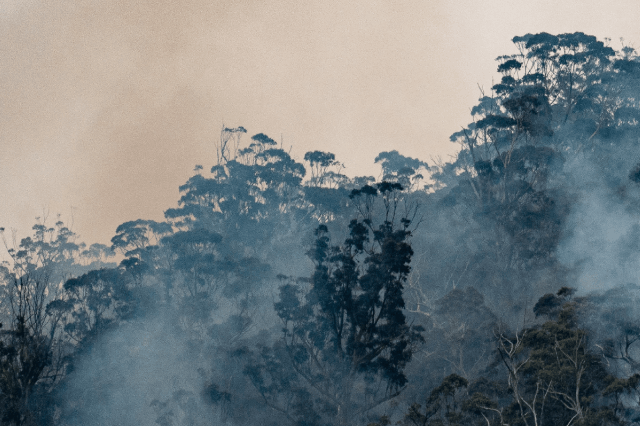

Positive screens on the other hand direct capital towards beneficial sectors and businesses like renewables, energy and water efficiency, education and healthcare. They demonstrate the power investors have to help shape the future. Explains Dr Stuart Palmer, “By shifting capital from fossil fuels to renewables for example, investors help to bring down the price of renewable energy and encourage investment in more flexible electricity grids and storage. This is in the interest of all of us, as risk-adjusted returns are going to be better in a low-warming world than a high-warming one.”

Influencing

As well as having impact by virtue of what they do and don’t invest in, deep green responsible investors should also use their position as large and long-term shareholders for good. They have a unique opportunity to exercise ongoing influence over boards and management advocating for better social, environmental and ethical behaviour and outcomes.

We have always seen this as our role. Over the years, AE has succeeded in securing commitments from companies to improve labour rights, animal welfare and environmental practices, as well as engaging with government on issues that concern our customers. We publish highlights of our advocacy and influence in our annual Sustainability Reports.

The green core

What distinguishes RIAA’s green ‘core’ of leaders? This core group uses ESG evaluation and screening but goes much further. They clearly state their responsible investment intention and back this up with a rigorous and systematic approach to deliver on this. They demonstrate explicit inclusion of ESG factors in their investment analysis and decisions and disclose the revenue and activity thresholds applied to a comprehensive range of negative and positive screens. They disclose full portfolio holdings, are better at disclosing their stewardship and active ownership activities (i.e. voting and proxy voting) and excel at reporting on their engagement with companies, including the nature of these activities and outcomes.2 In effect they are true to their comprehensive green label.

Greenwashing of real concern

Where green claims are not backed up by a truly rigorous approach to responsible investing, a fear of ‘greenwashing’ can undermine the integrity of responsible investing as a whole.

Where green claims are not backed up by a truly rigorous approach to responsible investing, a fear of ‘greenwashing’ can undermine the integrity of responsible investing as a whole. To effectively and authentically align investors to the global fight against climate change it is critical that these claims are true. Indeed, 82% of investors planning to invest responsibly in 2022 expressed concerns about greenwash.2

Regulators here and overseas are attempting to tackle this issue. In March 2021 the EU’s Sustainable Finance Disclosure Regulation (SFDR) came into force, designed to help institutional asset owners and retail clients understand, compare and monitor the sustainability characteristics of investment funds. In April, President Biden promised new emissions targets for the US and the SEC took aim at ESG disclosures. In July ASIC announced a review to address the threat of greenwashing and to improve governance and accountability in the market.3 Following COP26 in November, APRA released its final prudential guidance designed to assist APRA-regulated banks, insurers and superannuation trustees to manage the financial risks of climate change (CPG 229).

Says Dr Stuart Palmer, “We believe directing capital away from harmful sectors and towards smart businesses doing good for the planet, people and animals will help to create the equitable, sustainable world we all want to live in. So will influencing good companies to do better. We invest this way, not just because it is ‘green’ or ‘woke’, but because the fundamental sustainability of a company, how it cares for all its stakeholders and the world around it, determines how well it will cope with the challenging decades ahead. This to us is truly responsible investing”.

For more RIAA’s Responsible Investment Spectrum provides a useful framework outlining seven approaches to responsible investment.

1 Banhalmi-Zakar, Z & Parker, E. 2022. From Values to Riches 2022: Charting consumer demand for responsible investing in Australia, RIAA, Melbourne.

2 Banhalmi-Zakar, Z, Boele, N & Bayes, S 2021, Responsible Investment Benchmark Report 2021 Australia, RIAA, Sydney.

3 Company Director, AICD July 2021

If you would like to know more about our range of funds, or even how to get started with responsible investing, please get in touch with a member of our Business Development Manager team.

Stay in the know

Subscribe to our adviser newsletter to receive the latest news on ethical investing, fund insights, event and webinar invites and more.