Investing in the transition to zero emissions

To limit global warming to 1.5°C we need to reduce emissions to zero by 2050. To achieve this, society must eliminate or offset all greenhouse gas emissions. This ambitious goal is possible, but it will require major investment into innovative, low-carbon companies.

For decades, we have been investing in companies that are working to mitigate and solve the climate crisis while also delivering strong shareholder returns. Here’s how some of the companies we invest in are helping change the world.

1. Renewable power generation

Meridian Energy, a New Zealand-based company we invest in, provides power solely from hydroelectricity, geothermal and wind resources. With its subsidiary, Meridian Energy Australia, the company operates two Australian windfarms as well as the green electricity company Powershop. Meridian also operates windfarms in Antarctica and a solar plant in the United States.

Mercury Energy is another major New Zealand energy provider that derives renewable power from wind, hydro and geothermal stations. It also has a solar farm and a research and development centre that trials new innovations like battery storage and electric vehicle charging.

These companies show it’s possible to deliver strong financial returns to investors as well as benefits to the environment. Meridian Energy and Mercury were among of our best-performing stocks in the 12 months to 31 October 2019, returning 56% and 54%, respectively.

2. More efficient logistics

Just about every industry produces emissions, so they all need to reduce their carbon footprint to help combat dangerous global warming. In the logistics sector, transportation and plastic production have significant carbon footprints. Australian company Brambles, which we invest in, is one supply chain logistics company that’s using smart strategies to reduce emissions.

Brambles supplies plastic and wooden pallets and containers that can be shared and reused. The company takes a circular economy approach and is working towards achieving zero waste to landfill by 2020. Once its plastic products reach end-of-life they are either reground and recycled into Brambles products or sold to approved third parties for reuse. In 2019, 99.7% of the company’s wooden pallets were sourced from certified sustainable timber, with 100% targeted by 2020. Brambles also helps minimise the environmental footprint of its customers and supply chain by using collaborative transport to reduce the number of empty trucks or unnecessary trips, as well as choosing more efficient, lower carbon emitting modes of transport (like rail or sea) over air.

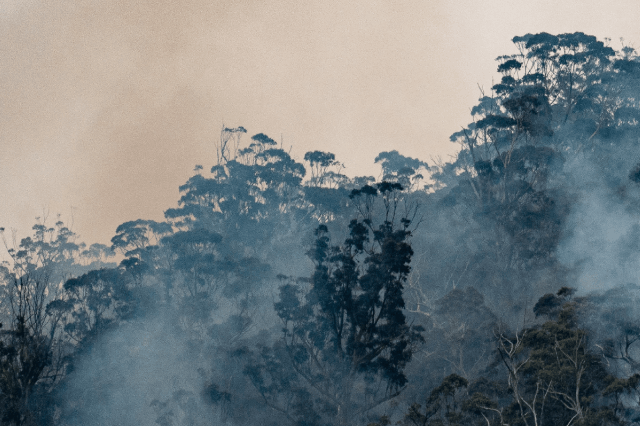

3. Sustainable insulation

It’s estimated that heating and cooling makes up a staggering 40% of a typical household’s energy usage. Insulation can significantly reduce the need for air conditioning or heating, thereby shrinking a building’s overall carbon footprint.

One of our international investments, Danish company Rockwool Group, is the world’s leading manufacturer of sustainable insulation products for the construction industry. Stone wool insulation is fire resistant and doesn’t create smoke or toxic gases in a fire, making it a safer choice for insulation in buildings. It contains an average of 75% of recycled content, compared to fibreglass which averages about 40% to 60%.

Stone wool can also absorb or repel water – so hydroponic farmers can use it in place of soil to grow fresh produce with less water. What’s more, it is possible to use stone wool to drain water after heavy downpours from roofs into stone wool basins, helping resupply precious groundwater.

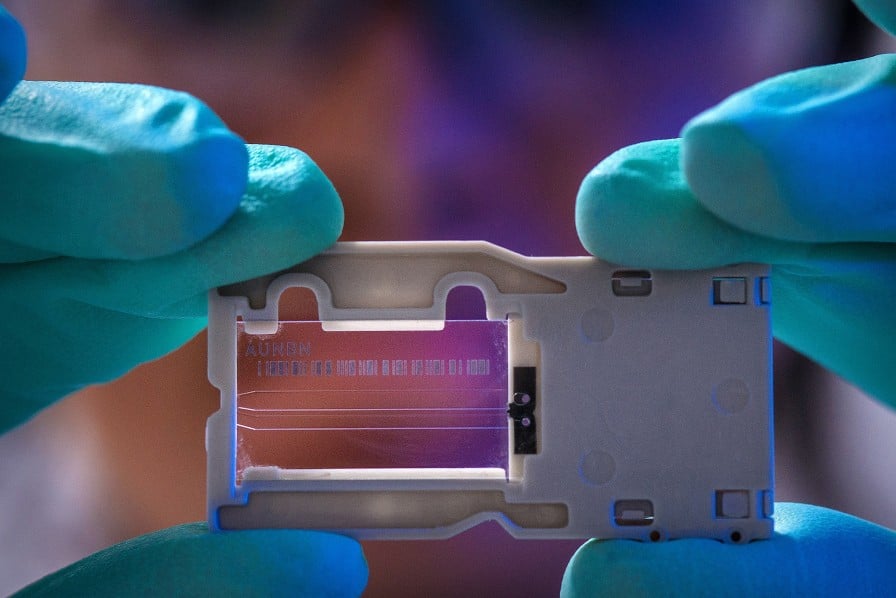

4. Better solar panels

Solar photovoltaic systems can power anything from tiny applications like calculators to huge power generation facilities. In 2018, solar PV generation grew by 31%, more than all other renewable technologies in that year.

One of our US investments, First Solar, is a leading manufacturer of photovoltaic modules. It operates and maintains some of the world’s largest grid-connected photovoltaic power plants, leveraging its enormous scale and the efficiency of its Series 6 solar panels to deliver strong shareholder returns.

5. Reducing and recycling e-waste

In 2016 alone, the world generated about 44.7 million metric tonnes of e-waste – that's 6.1 kg per person. E-waste consists of things like computers, TVs and smartphones. Dumping valuable metals and electronics into landfill is a huge waste of finite materials. It also contributes to pollution, and their toxic by-products can lead to serious health problems.

By investing in global metal and electronics recycling company Sims Metal Management, we’re helping reduce waste and preserve valuable resources for future use. Operating across five continents, Sims Metal Management purchases, processes and recycles metal and non-metal waste from businesses, other recyclers and the public.

Sims’ new business goals include expanding into the waste-to-energy business. As part of this business they have entered into a joint venture with LMS Energy, with the aim to use landfill gas to generate electricity.

Want to find out more?

These are just some of the companies we invest in that are helping to bring about a more sustainable, low-carbon future. You can find out more about the companies we invest in here.

We invest in companies to have a positive impact on the planet, people and animals. Start investing ethically with your Super and Managed Funds^.