How climate change is pushing up home insurance premiums

- Energy prices and general insurance premiums are big contributors to the cost of living crisis

- Insurance premiums have been increasing faster than any other household expense

- Climate change is a significant driver of insurance premium rises, and in some cases leaves people uninsured

- Insurance companies are in some cases worsening the climate emergency by underwriting fossil fuel expansion

It’s become easy to put cost of living pressures all into one bucket and blame it on the economy or, well, just how things are.

We are now three years into the cost of living crisis. Before 2022 the phrase hardly garnered a mentioned in media or internet searches, but now it’s consistently among the top trending phrases, Google Trends shows.

For many of us, that probably means three years of work arounds like coffee at home rather than cutting off an arm and a leg to pay coffee shop prices, or relegating meetups at bars and restaurants to happy hour or two-for-one Tuesdays.

We’ve just had a cost of living-themed budget and election. It’s no wonder people may be feeling fatigued or possibly a bit dis-empowered by it all.

What if we could feel more empowered and find genuine solutions to the cost of living crisis by finding a way to reframe the problem?

Energy & insurance

Take the cost of your energy bill for example. Thinking about it from a climate perspective opens up a load of different ways to bring energy bills down, something we talked about in our taking action with your energy usage series of articles. Energy consumption accounts for anywhere between 2% and close to 14% of household yearly incomes, with energy costs disproportionally hitting lower income households1.

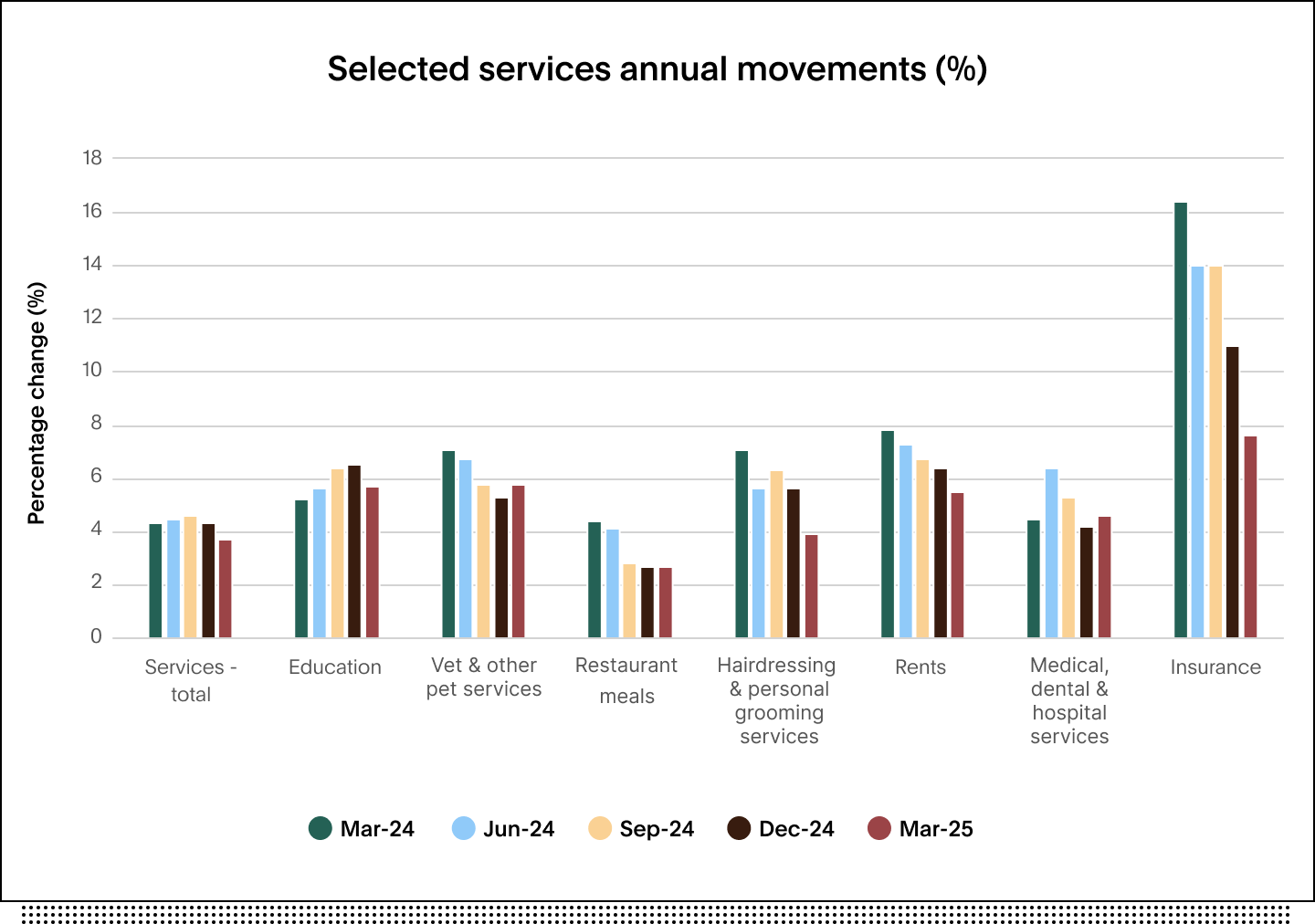

Energy costs aside, the fastest increasing contributor to the cost of living is actually the amount we pay for general insurance, like home, contents and car insurance, Australian Bureau of Statistics stats show.

General insurance costs are almost off the charts in terms of their increasing contribution to everyday life.

Source: Australian Bureau of Statistics, Consumer Price Index, Australia March Quarter 2025

But what difference can our individual efforts make towards bringing down the price we pay to protect our home and belongings?

The second article in this series will suggest how we might personally be able to contribute to bringing insurance premiums down.

Understanding why insurance premiums have been rising so fast is a good start.

Some pockets previously hit by climate disasters are either not being insured, or the cost is becoming prohibitive.

Why are general insurance premiums so high?

People might see high general insurance premiums as another symptom of the cost of living crisis, but it’s not. A significant factor driving up insurance premiums is climate change2.

Climate change is creating more intense and frequent extreme weather events, particularly impacting Australians living in areas prone to flooding, sea level rises, coastal erosion, cyclones, bushfires and heat waves3.

Remember the Black Summer Bushfires? In 2019-2020, on the back of the hottest and driest year on record at the time, over 3,000 homes were lost and 24 million hectares of property destroyed costing more than $10 billion. Since then, the North-East NSW and Southeast Queensland floods tragically claimed more than 20 lives and costed more than $3.5 billion.

The list of extreme weather events has continued, with no less than 30 weather events declared disasters in 2024 alone. The same is happening overseas. People are leaving their homes and communities because they can no longer afford to insure their homes, and renting or buying a home has become much more expensive4.

Some pockets previously hit by climate disasters are either not being insured, or the cost is becoming prohibitive. There are a lot of highly populated areas in NSW, Queensland and South Australia where premiums have gone up significantly, reflecting the new risks climate change brings to properties and possessions.

So what can we do?

It’s worth acknowledging high insurance premiums and non-insurability has likely less to do with traditional cost of living catalysts, and more to do with climate change.

There’s also an irony worth pointing out – that some insurance companies are still underwriting projects and working with companies expanding fossil fuels, which pull us further away from science-based climate goals.

So, these insurers are essentially exacerbating the very thing (climate change) that is forcing them to increase premiums and, in some cases, withdraw insurance all together.

We see this as both as ethical concern and a financial risk at Australian Ethical.

It’s an ethical issue because insurers are contributing to a worsening climate situation by underwriting projects unaligned with scientific guidance. There are also the ethical concerns raised by the impact of unaffordable insurance on communities and lives.

We see it as a financial risk for insurers and their long-term investors. Future insurance revenue will likely be wiped out if general insurance books shrink because climate change means more property is becoming uninsurable or insurance is becoming unaffordable.

This is a strategic focus of our stewardship work, and we are asking questions of listed insurer QBE which we plan to voice at the company’s upcoming AGM on May 9.

This is a strategic focus of our stewardship work, and we are asking questions of listed insurer QBE which we plan to voice at the company’s upcoming AGM on May 9.