Our influence for a better world

We believe we can create a better world by using our money and voice to support more responsible businesses, government, and consumption.

![]()

Capital for ethical investments

Increased investor demand for ethical over unethical companies can increase access to lower-cost funding for ethical companies. At the same time, it can restrict funding and increase funding costs for unethical companies. This effect can scale with growth in demand for genuine ethical and sustainable investment options.

![]()

Public divestments

Our public divestment and exclusion can signal ethical concerns about unsustainable products and practices to companies, other investors, governments, consumers and citizens. This public signal, combined with our ethical engagement and advocacy, can help influence positive changes in behaviour, government policy and investment and consumption choices. We report on engagement priorities, activity and progress in our annual Sustainability Report.

![]()

Our voice

We engage with select companies to improve key business practices. Our ethical screening can also help our influence by providing positive consequences for successful engagement (inclusion in ethical and sustainable portfolios) and negative consequences for unproductive engagement (exclusion or divestment).

Our history of influence

It began in 1986 when our founders set out to invest for a better world by using money as a force for good. It’s an investment philosophy that remains unchanged, in an ever-changing world.

The carbon intensity of our share investment portfolio is significantly lower than the benchmark(1,2), whilst our investment in renewable energy powers on. Through our ethical stewardship we aim to support a transition to a more sustainable economy and society. Since 2000, we have donated more than $9 million to our Foundation, driving positive outcomes for the planet, people and animals.

75% less carbon intensive

The carbon intensity (tonnes of CO2 equivalent per dollar company revenue) for our listed share investments at 30 June 2024 is 75% lower than a mainstream share market benchmark(1,2)

2.3x revenue in sustainable solutions

The listed companies we invest in earn 2.3 times the revenue from sustainable impact solutions at 30 June 2024 than a mainstream share market benchmark(1,3)

5.2x clean energy solutions

Our listed share investments at 30 June 2024 have 5.2 times the investment in renewables and energy solutions than a mainstream share market benchmark(1,3)

$11M+ donated since 2000

We donate 10% of our profits (after tax and before bonus) each year through the Australian Ethical Foundation. Since 2000, we have donated $11M+ to help achieve the Foundation's vision of directing as much philanthropy as possible towards the most effective solutions addressing the climate emergency.

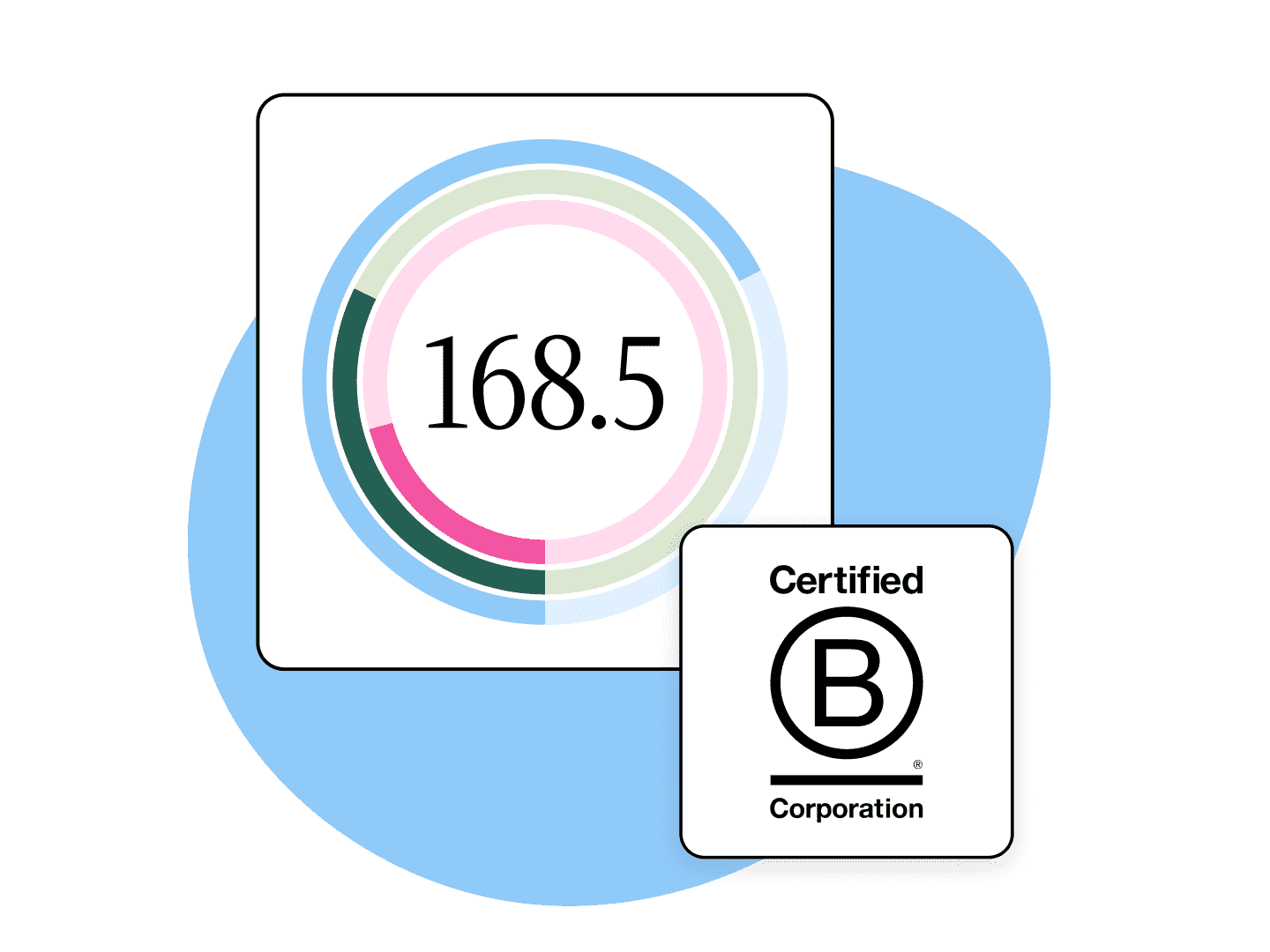

Certified B Corporation

In 2014, we became the first listed company in Australia to earn Certified B Corporation status, an independent assessment on whether a ‘for-profit’ company is meeting high standards of social and environmental performance, accountability, and transparency.

Our latest score, 168.5, awarded at recertification on 13th July 2023, was the highest score for any B Corp in Australia and Aotearoa New Zealand and is more than double the score needed to gain B Corp accreditation.

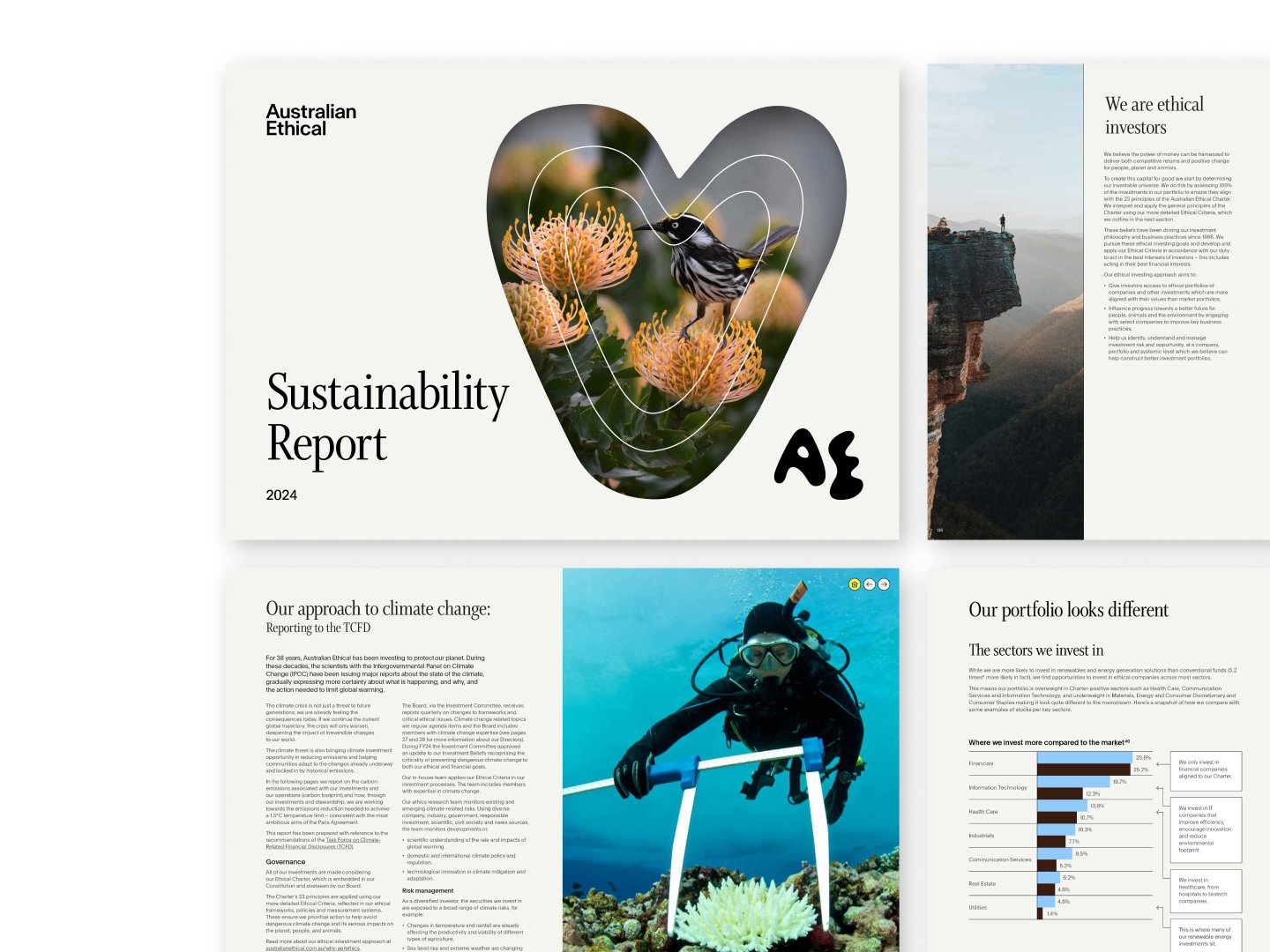

2024 Sustainability Report

In this report we seek to show how our investments, stewardship, climate action, community support and people and culture initiatives are all governed by the principles of the Australian Ethical Charter created by our founders in 1986.

The shares analysed for the Australian Ethical funds and options are the listed shares that those funds and options invest in and for which we have relevant sustainable revenue data or climate data.

For the comparisons to benchmark we use shares in a basket of companies from general share market indices which also have the relevant sustainability data. For the comparisons we have selected indices which we consider to be an appropriate investment benchmark for our listed share investments as follows:

International Shares Fund and International Shares Option:

- The benchmark index is the MSCI World ex Australia Index.

Australian Shares Fund, Australian High Conviction Fund and Australian Shares Option:

- The benchmark index is the S&P ASX 300 Index.

All other funds and options:

- The benchmark index is a blend of the S&P ASX 200 Index for Australian and New Zealand shares and the MSCI World ex Australia Index for international shares.

We have not selected benchmark indices based on their ethical, sustainability or ESG characteristics. The industry mix and other characteristics of companies comprising the Australian Ethical investments and benchmark indices are different.

We have used data and analysis tools provided by global research firm MSCI ESG Research LLC when calculating the information about sustainable revenue, carbon intensity and investment in renewables and energy solutions. The information presented is only for investments in listed shares in those companies which have been analysed by MSCI ESG Research for their relevant sustainability characteristics.

More information on MSCI carbon footprinting methodology and metrics is available here.

More information about MSCI measurement of companies’ sustainable revenue is available here and here.

None of MSCI ESG Research LLC or its affiliates (MSCI ESG Research) is responsible for the sustainability information or the way we have used their data and tools. MSCI ESG Research (1) retains copyright in all its data; (2) does not warrant or guarantee the originality, accuracy and/or completeness of their data; (3) makes no express or implied warranties of any kind, and disclaims all warranties of merchantability and fitness for a particular purpose; (4) has no liability for any errors or omissions in connection with their data or for our reporting and use of their data; and (5) without limiting any of the foregoing, has no liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. Information provided by MSCI ESG Research may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for, or component of, any financial instruments or products or indices. Further, none of the information provided by MSCI ESG Research can in and of itself be used to determine which securities to buy or sell or when to buy or sell them.

Investment in renewables and energy solutions includes investment in renewable energy generation from wind, solar, geothermal, biomass, small scale hydro (25 MW or less) and wave tidal energy. Also included are biofuels, waste-to-energy, renewables equipment (e.g. solar inverters and wind turbines), transmission of renewable energy, and batteries and other energy storage supporting renewable energy.

We only present the sustainability information where at least half the fund or option is invested in listed shares for which we have the relevant sustainability data.

Investment carbon footprint metrics need to be used with caution. Company carbon data is historical, it often includes estimates or is incomplete, and it may include errors and be out of date. Companies make different decisions about what they do and don’t include when measuring and reporting their operational emissions. There are also different portfolio measurement methodologies, and different carbon metrics which can be used to assess carbon footprint, each with different strengths and weaknesses. Similar limitations apply to measurement of other types of impact of companies. Company reporting of the revenue they earn from different products and services may be inaccurate or incomplete, and MSCI may make estimates in breaking down and categorising company revenue. There are different methodologies and frameworks for classifying sustainable products and services and for taking account of negative impacts of a company’s operations.

-

Compared to a general share market benchmark selected as an appropriate investment benchmark for our total investment in listed shares and based on shareholdings at 30 June 2024 and analysis tools provided by external sources accessed on 12 July 2024. See more details.

-

Carbon/CO2e intensity of listed companies whose shares we invest in across our funds and options, measured as tonnes CO2e per $ revenue. This should not be considered representative of individual funds or options which will have their own mix of share and other investments. See more details.

- Based on the revenue from sustainable impact solutions earned by the listed companies and the proportion of the listed share investments in renewables and energy solutions. Sustainable impact criteria and data is provided by external sources and aims to measure revenue exposure to sustainable impact solutions and support actionable thematic allocations in line with the U.N. Sustainable Development Goals (SDGs), EU Taxonomy of Sustainable Activities, and other sustainability related frameworks. See more details.