We have seven ethical super investment options ready-made for you to pick from to suit your needs. Each have different risk profiles for you to choose from based on your financial objectives, risk tolerance and personal financial situation.

Tap on the dotted lines for explanations of financial or ethical investment terms

Suitable for members who:

- want a low risk of capital loss and low volatility with a short investment timeframe

- Risk

-

Very low

- Min. investment timeframe

-

1year

- Strategic asset allocation

-

100% defensive

Suitable for members who:

- are closer to, or in retirement who need to protect their retirement savings and keep up with inflation

- want a low volatility option

- Risk

-

Low to medium

- Min. investment timeframe

-

4years

- Strategic asset allocation

-

32.5% growth67.5% defensive

Suitable for members who:

-

are comfortable with a medium to high level of risk that have an investment timeframe horizon of at least 8 year

- Risk

-

Medium to high

- Min. investment timeframe

-

8years

- Strategic asset allocation

-

72.5% growth27.5% defensive

Suitable for members who:

- have a longer timeframe to accumulate retirement savings

- are comfortable with short-term market fluctuations

- Risk

-

High

- Min. investment timeframe

-

9years

- Strategic asset allocation

-

85% growth15% defensive

Suitable for members who:

- seek capital growth through growth assets such as Australian and international shares, unlisted property and alternative assets

- longer timeframe and higher risk tolerance

- Risk

-

High

- Min. investment timeframe

-

10years

- Strategic asset allocation

-

95% growth5% defensive

Suitable for members who:

- seek exposure to international companies who are comfortable with short term volatility

- longer timeframe and higher risk tolerance

- Risk

-

High

- Min. investment timeframe

-

7years

- Strategic asset allocation

-

95% growth5% defensive

Suitable for members who:

- seek capital growth through long-term investments

- have a higher tolerance for risk

- Risk

-

Very high

- Min. investment timeframe

-

7years

- Strategic asset allocation

-

95% growth5% defensive

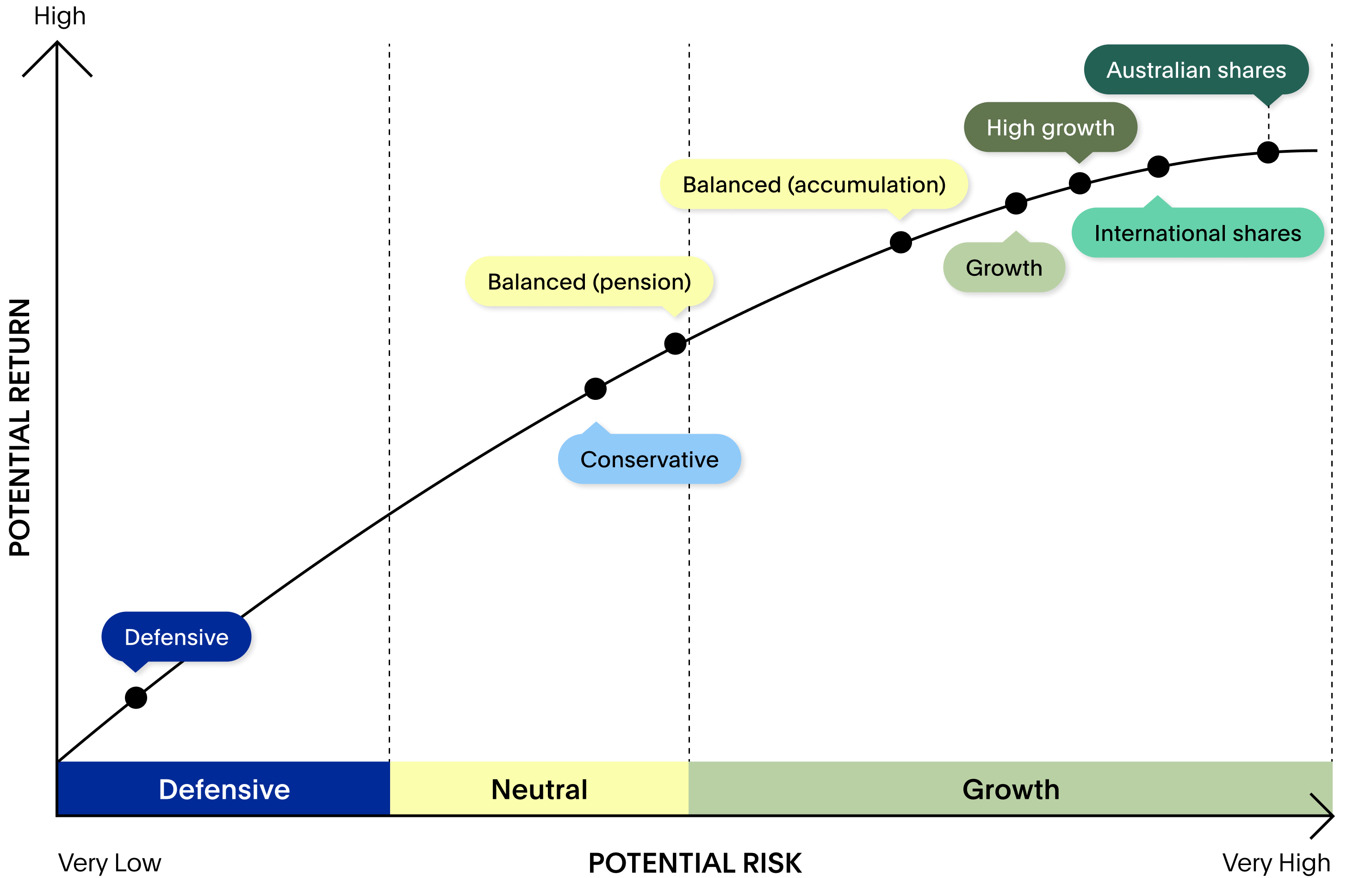

Defensive: You want to keep your money safe and earn a steady, small return. You’re planning to use your money soon, so you don’t want to take big risks.

Neutral: You’re okay with a bit of up and down, but still want your money to grow slowly over time. You might use it in the medium term, so you want a balance between safety and growth.

Growth: You don’t need the money for a long time, so you’re happy to take more risks to grow your money more. You’re not worried about short-term ups and downs.