What is ethical stewardship? (and how we do it differently)

Our purpose has always been to invest for a better world.

While steering capital to companies we’ve assessed as positive and restricting+ investment in harmful ones is a critical piece of the puzzle, it isn’t enough on its own to create the transformation the planet needs to prosper.

The fact that we don’t invest in a company doesn’t mean they stop existing. Even if we only invest in companies with a low emissions footprint, that won’t directly reduce emissions globally, which is what we need.

So we also influence change through ethical stewardship. This involves leveraging our position as a shareholder and investor to have a voice on systemic issues like climate change, biodiversity loss, human rights abuse and animal cruelty.

And as we grow – now representing more than $9 billion invested – our influence increases.

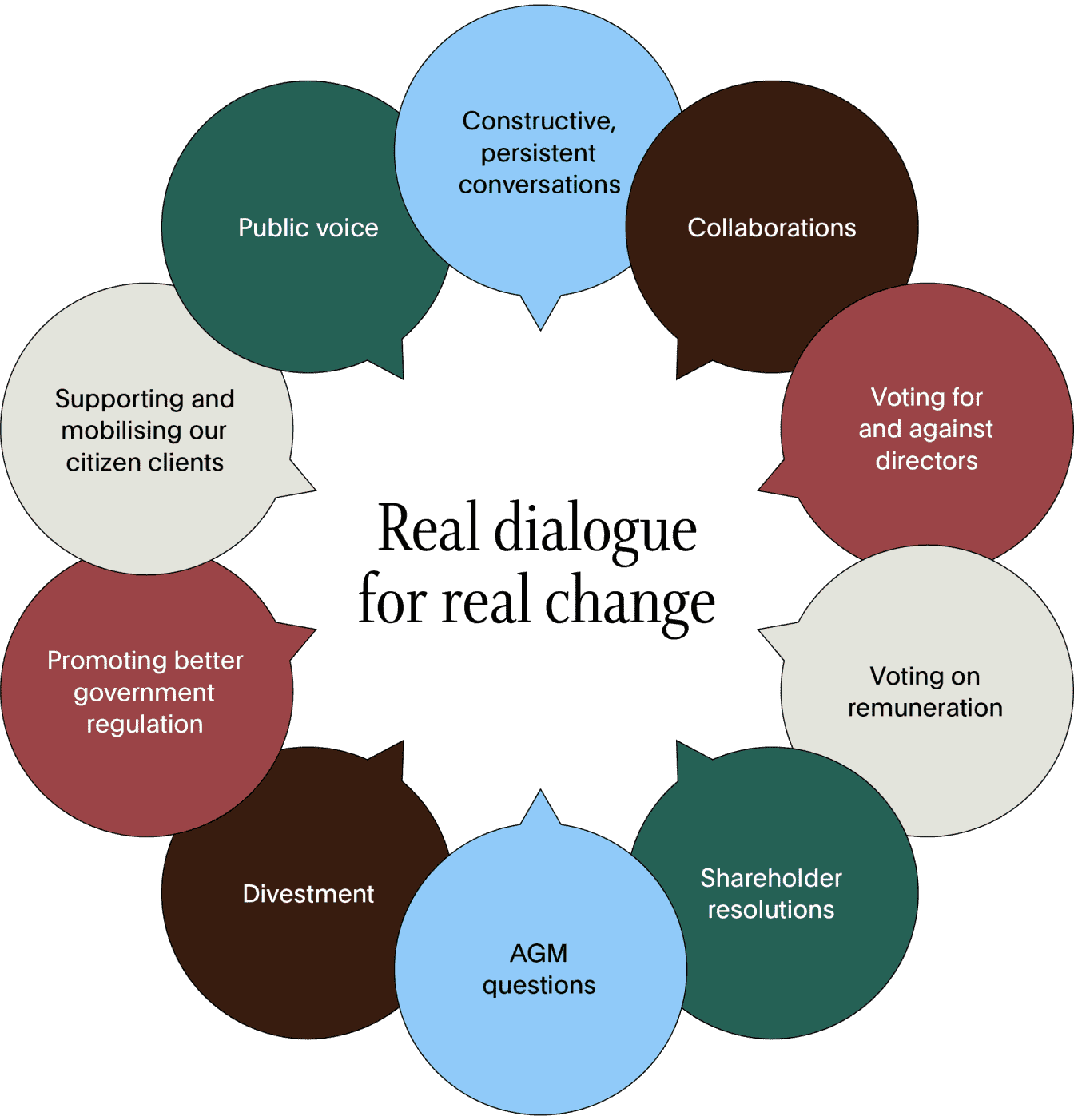

What does ethical stewardship involve?

As an ethical investor focussed on achieving real world outcomes, we are prepared to use every tool at our disposal.

This may include co-filing shareholder resolutions, voting against company directors, using the media to put pressure on recalcitrant companies, as well as divesting and making those divestments public and impactful.

As an ethical investor focussed on achieving real world outcomes, we use every tool at our disposal.

Our stewardship activities aren’t restricted to the companies we invest in. We see our role as much broader if we are to achieve system-level change. We also focus our efforts on other investors, governments, regulators, standard-setting bodies, and other organisations.

Where do we focus our ethical stewardship?

We seek to be strategic rather than reactive in our engagements.

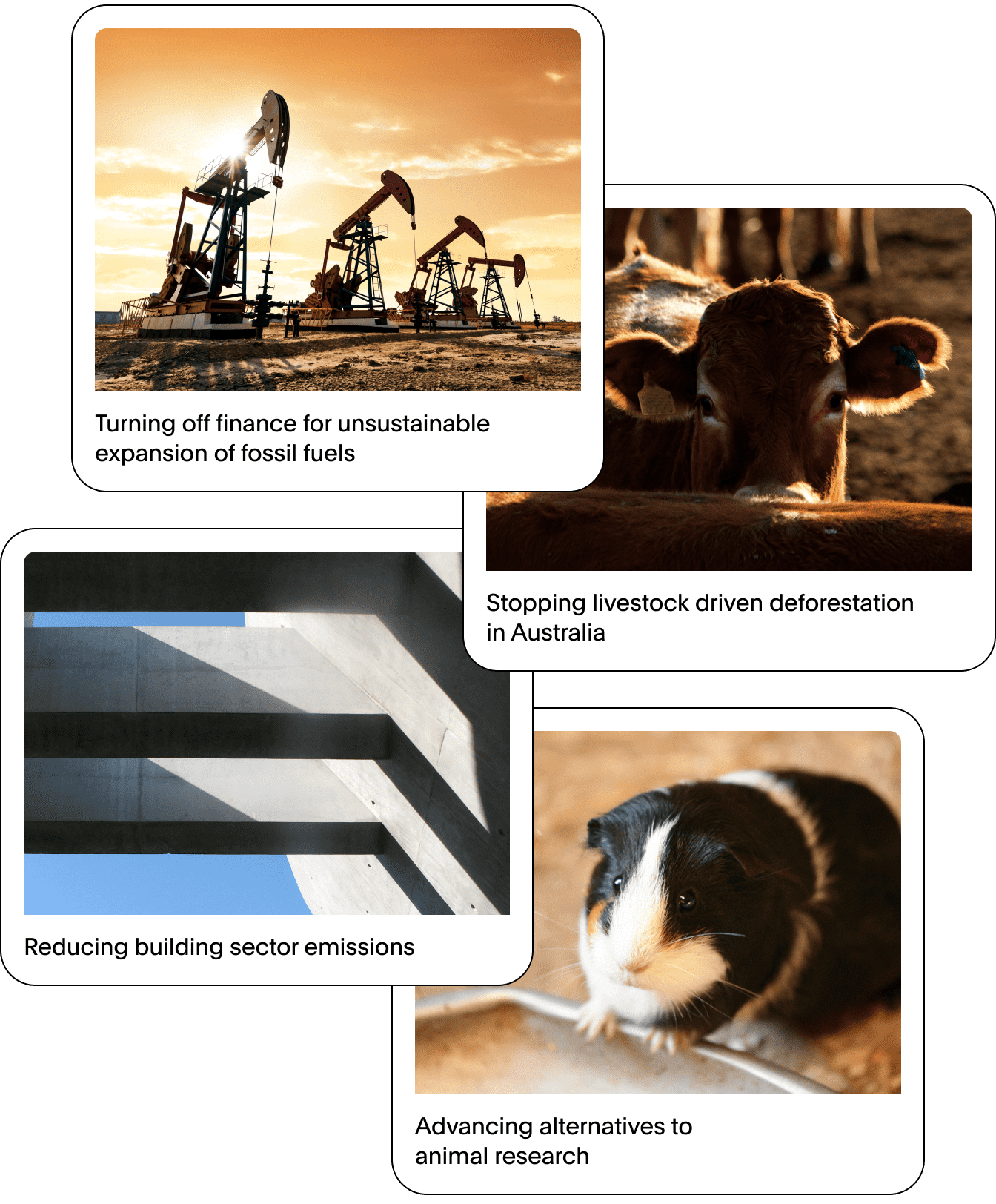

We start by considering if the issues are systemic, widespread, long-term, or create an existential challenge. Or if we can help reduce suffering, and protect the voiceless, vulnerable or irreplaceable. Our process helps us to narrow down where we are best placed to make a difference. It has led us to four target areas:

- turning off finance for the unsustainable expansion of fossil fuels

- stopping livestock driven deforestation in Australia

- reducing building sector emissions

- advancing alternatives to animal research

We’re not claiming we can solve these issues ourselves. However, we think we can leverage our position as an investor to positively influence these issues, and we believe we have a responsibility to do so.

Not all investors think this way about stewardship – many investment firms don’t seek to achieve real world outcomes that address system-level risks as their motivation for engaging in stewardship, recent research shows1.

Our process helps us narrow down where we are best placed to make a difference. It has led us to these four target areas.

System-level thinking

System-level risks are the big issues that might threaten our societies and entire civilisation. If we don’t address system-level risks, we can’t have a stable financial system, which will make it much more difficult for investors to generate returns for members. For instance, a planet too hot for humans to exist and function is a system-level risk we believe needs to be addressed for society to function.

While we are seeing an increase in stewardship activity among responsible investors generally2, we believe there needs to be a greater shift in focus to system-level risks among investors.

We want to protect our ability to make money for investors, but this can’t be done when looking at risks and opportunities through the prism of an individual company. In fact, we believe investors who conduct stewardship with a narrow focus on what is financially beneficial to an individual company could be exacerbating system-level risks.

For instance, an investor in a fossil fuel company focussed on individual company performance and not system-level risks might not be willing to engage in stewardship that encourages the company to wind down its fossil fuel operations, even though that might be necessary to avoid levels of warming that will destabilise financial systems.

Can ethical stewardship create real world outcomes?

Advocating for a better world requires strategy and persistence. Our Impact & Ethics Research team engaged3 over 250 companies in FY23. More than 65 of these were ‘proactive’ engagements, meaning we did more than simply sign on to an engagement coordinated by another organisation.

And we’re seeing progress. In the last financial year, 25% of the companies we proactively engaged with committed to change.

But this is the easy way to measure our stewardship outcomes, and this kind of reporting is commonly how you’ll see investment firms prove their stewardship credentials.

The problem with this kind of approach is numbers can result in investors undertaking activities for the sake of ticking boxes and can mask genuine intent.

We try to measure progress on our stewardship activity by describing the outcomes we want to achieve, and then working back from there, defining the steps we need to take to reach the goal. You can see examples of this reporting approach in our recent Stewardship Report.

In the case of fossil fuel financing, we want the banks to stop financing unsustainable fossil fuel expansion. To get there we will need to get more investors putting pressure on banks to be better at assessing which projects and companies they provide funding to.

To that end, in recent years together with Market Forces we’ve co-filed shareholder resolutions with some of the Australian banks, we’ve publicly challenged business leaders at bank AGMs, and we’ve had robust discussions with senior representatives of the banks (including board members) both publicly and privately.

In November 2022, we called on the NSW Government and Lendlease to be transparent about the width of the koala corridors. Our engagement with Lendlease had since stalled, and in March 2023, we divested from the company.

We’ve seen some good outcomes. In the last year, we’ve seen all major Australian banks refuse to refinance Whitehaven Coal, and CBA has ruled out project finance for new and expansionary oil and gas extraction.

In FY24 we co-filed shareholder resolutions with NAB and Westpac, asking the banks to be forthcoming with more detail on how they’re assessing the climate transition plans of their oil and gas customers.

We then undertook a campaign to encourage support for the resolutions, sharing detailed investor briefings and co-hosting investor discussions. The resolutions received record support at the recent Annual General Meetings.

Accelerating change

There’s much more to do, with time fast running out when it comes to climate change. We see a few loopholes in the recent commitments from the banks, which means we will continue to focus on these and escalate our engagements as we move forward.

The same is true for our other target areas.

We’ll continue to use our stewardship tools to influence companies, governments and other organisations to make genuine, credible efforts to address the biggest challenges of our times.

Learn more about Australian Ethical and how we can help you invest ethically.

+ Our investment restrictions include some thresholds. Thresholds may be in the form of an amount of revenue that a business derives from a particular activity, but there are other tolerance thresholds we can use depending on the nature of the investment. We apply a range of qualitative and quantitative analysis to the way we apply thresholds. For example, we may make an investment where we assess that the positive aspects of the investment outweigh its negative aspects. For information on how we make these assessments for a range of investment sectors and issues such as fossil fuels, nuclear power, gambling, tobacco, human rights, and many others, please read our Ethical Criteria.

1 Top five goals of stewardship mentioned in stewardship codes and standards, stewardship policies of investors and interviews – Pg 10, Responsible Investment Association Australiasia Stewardship report, 2022 728RIAA_Stewardship-Report_FINAL.pdf (responsibleinvestment.org)

3 We count one engagement where we engaged with a company on a topic or series of topics. There may be multiple activities within that engagement. We may count two engagements with a company if there were separate activities on entirely separate topics. For example, we had one engagement with Boral in relation to its efforts to align with the climate transition (as lead CA100+ investor for Boral) and a separate engagement with Boral in relation to worker safety.