Beyond the ASX20: Are small caps set to outshine the giants?

For years, Australia’s biggest companies have been the market darlings. Investors have flocked to the familiar names – Commonwealth Bank, Wesfarmers, Telstra – especially through bouts of inflation, rising rates and global uncertainty. Their scale and perceived stability attracted capital, lifting large-cap indices like the ASX 20 and ASX 200 to record highs1.

But there’s a catch. Success has pushed share prices of the country’s biggest companies beyond earnings reality. The average forward price-to-earnings multiple of the ASX 200 now sits around 20 times – more than two standard deviations above its long-term average of ~14.9x2 (i.e., statistically speaking this level or higher should only occur around 2.5% of the time). Yet earnings are going the other way. Analysts have been downgrading forecasts, and the top 20 largest companies in the country have now recorded consecutive years of profit contraction3.

Put simply, valuations at the top end are looking stretched, and the risk-reward trade-off for large caps is looking increasingly unbalanced.

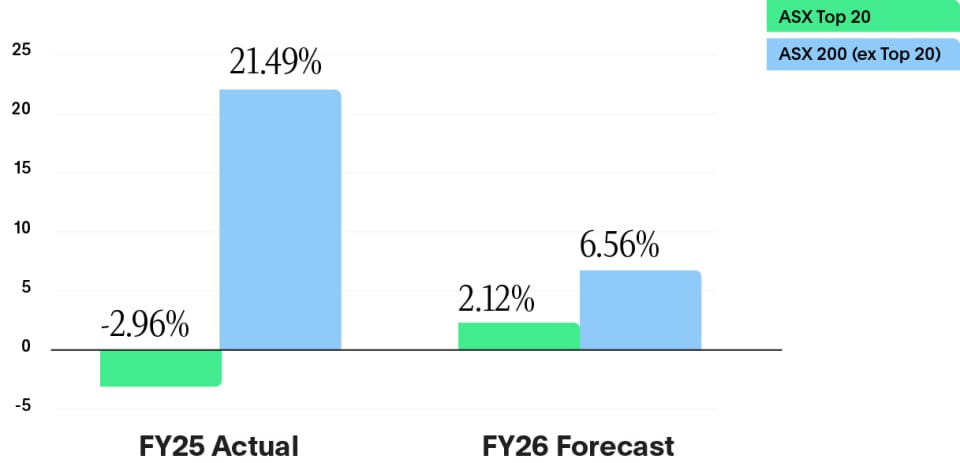

ASX earnings: Big company drag

Annual % growth rate

Source: Factset

Crowded at the Top

This disconnect between valuation and earnings growth matters. For all their size, the biggest companies can only deliver so much growth.

With share prices already at the upper end of the historical levels, even strong earnings results have struggled to justify current valuation multiples. Investors chasing “safety” have effectively bid up prices to what seems to be unsustainable levels, leaving little room for upside – and plenty of scope for disappointment.

Meanwhile, further down the market, a different picture is emerging.

Turning point for small caps?

It’s already been a big year for the smaller capitalised companies, and there are signs to suggest there may be may be more to come.

In the first nine months of 2025, , the ASX100 large-cap benchmark rose an impressive 10.4%, while yet the ASX Small Ordinaries Index return was more than double (22.8%)4.

For the first time in years, it seems investors are gravitating towards the potential earnings growth outside the top 20 and away from the favour of the safety of the leaders. Given small cap multiples are still much lower than large caps, their potential upside is greater.

While the long-term record in Australia has favoured large caps5, history also shows that small caps can deliver bursts of outperformance when the cycle turns.

With interest rates expected to continue to ease, these conditions look more like the kind of environment where small caps shine.

Valuations are central to the case for a potential small caps resurgence. Australian small caps are still trading at deep valuation discounts compared to their larger cap counterparts, even with the recent increase in returns. That gap represents both inefficiency and opportunity. Smaller companies are less researched, less widely owned, and often mispriced. For skilled active managers, this creates fertile ground to identify businesses with genuine growth prospects at compelling entry points.

And unlike many of their large-cap counterparts, small companies still have runway. They’re earlier in their growth journey, often more nimble, and better positioned to expand into new markets or scale their models.

That means they have the potential not only to meet, but to exceed, investor expectations — a stark contrast to large caps, where the expectations embedded in current valuations already look ambitious.

Given small cap multiples are still much lower than large caps, their potential upside is greater.

Small caps ‘secret sauce’

Because they are less widely researched than larger capitalised companies, investing in small caps calls on continuity of relationships with management teams and deep knowledge of business.

Australian Ethical has more than a decade track record investing in small cap companies, with a particular focus on companies in the healthcare and information technology sectors. This sector focus – guided by our Ethical Charter – means our portfolio managers and analysts understand well the companies and the issues that matter to the growth and prospects of these businesses.

Beyond sectors, analysis of the Australian Ethical Emerging Companies Fund portfolio highlights a cross section of companies in different life stages and with different return profiles.

| Sector allocation | Description |

|---|---|

|

23% Scaling up |

Companies with innovative medical, technological solutions, many on the cusp of positive free cash flow , positioned to deliver sharp earnings growth as fixed costs are absorbed and margins expand. |

|

62% Quality stable industrials |

Established small-cap businesses with proven models, strong management, and growth rates that outpace large-cap peers. |

| 5% Turnarounds |

Select positions in businesses undergoing restructuring or operational improvement, with potential for material re-rating. |

|

10% Cash |

Ready to deploy in new opportunities and capital raisings. |

The Australian Ethical Emerging Companies fund is built to capture opportunities across the small-cap lifecycle, from early-stage profitability through to more established industrials and innovative medical technologies. Our long-term approach allows us to participate as these companies scale, expand margins, and unlock value often overlooked by the broader market.

Learn more about where the Australian Ethical Emerging Companies Fund invests or apply now

1 Morningstar Hub- Do good things come in small cap packages

2 Factset October 2025

3 Morningstar- ASX opportunities after earnings season

4 Morningstar Direct

5 CFA Institute- Small caps vs. large caps: The cycle that's about to turn

This information is of a general nature and is not intended to provide you with financial advice or take into account your personal objectives, financial situation or needs. Before acting on the information, consider its appropriateness to your circumstances and read the product disclosure statement (PDS) and target market determination (TMD) for the relevant product and the financial services guide available on our website.

Australian Ethical does not guarantee the performance of any fund or the return of an investor’s capital; past performance is not a reliable indicator of future performance.

Australian Ethical Investment Ltd (ABN 47 003 188 930, AFSL 229949) is the Responsible Entity for the Australian Ethical Managed Funds and offeror of the interests in the Australian Ethical Retail Superannuation Fund (ABN 49 633 667 743,USI AET0100AU), issued by the Trustee, Australian Ethical Superannuation Pty Limited (ABN 43 079 259 733, RSE L0001441, AFSL 526 055).

Get in touch

If you would like to find out more about our Emerging Companies Fund, fill in your details below and our Business Development team will be in touch.