Who we are

Ethical and sustainable investing isn’t just a part of what we do – it’s who we are. And while we’ve evolved in many ways since starting in 1986, we have always stayed true to this.

Now, we manage $14.28 billion for more than 134,000 funded customers (managed fund investors and funded superannuation members) as at 30 September 2025.

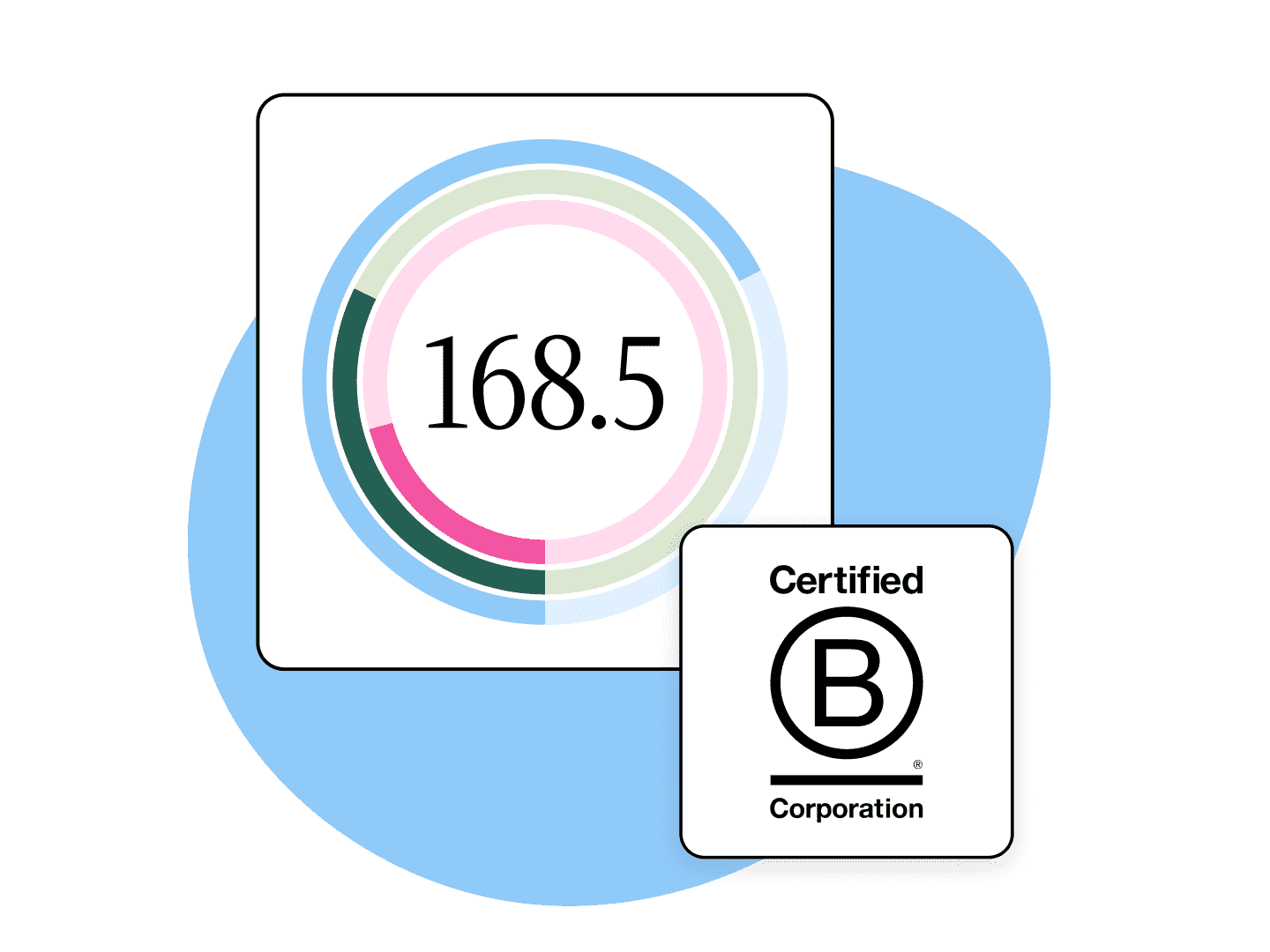

Certified B Corporation

In 2014, we became the first listed company in Australia to earn Certified B Corporation status, an independent assessment on whether a ‘for-profit’ company is meeting high standards of social and environmental performance, accountability, and transparency.

Our latest score, 168.5, awarded at recertification on 13th July 2023, was the highest score for any B Corp in Australia and Aotearoa New Zealand and is more than double the score needed to gain B Corp accreditation.

2025 Sustainability Report

In this report we seek to show how our investments, stewardship, climate action, community support and people and culture initiatives are all governed by the principles of the Australian Ethical Charter created by our founders in 1986.

Working at Australian Ethical

We are a group of passionate people working together for a positive influence. Since 1986, we’ve been focusing on a brighter future for people, planet and animals by investing ethically with both the head and the heart.