How we’re challenging banks on their lending

The significant increase in support from bank shareholders for the climate resolutions creates a strong platform for us to build pressure on the banks to turn off financing for fossil fuels.

We invest in some banks because we have assessed that overall they can create a positive impact on society, and will be essential to support the energy transition.

Stopping financing for fossil fuel projects is one of our strategic stewardship initiatives that we’ve been focused on over the last decade. We think that influencing the lending policy of a diversified financial institution is a strategy where we can make the most difference to the fossil fuel industry in Australia and we have made material progress.

As part of this strategy, we’ve been creating a bit of a stir at bank Annual General Meetings (AGMs) recently – here’s why.

At the end of 2023, we asked NAB and Westpac shareholders to voice their concerns about the banks’ lending policies to fossil fuel companies. And shareholders did.

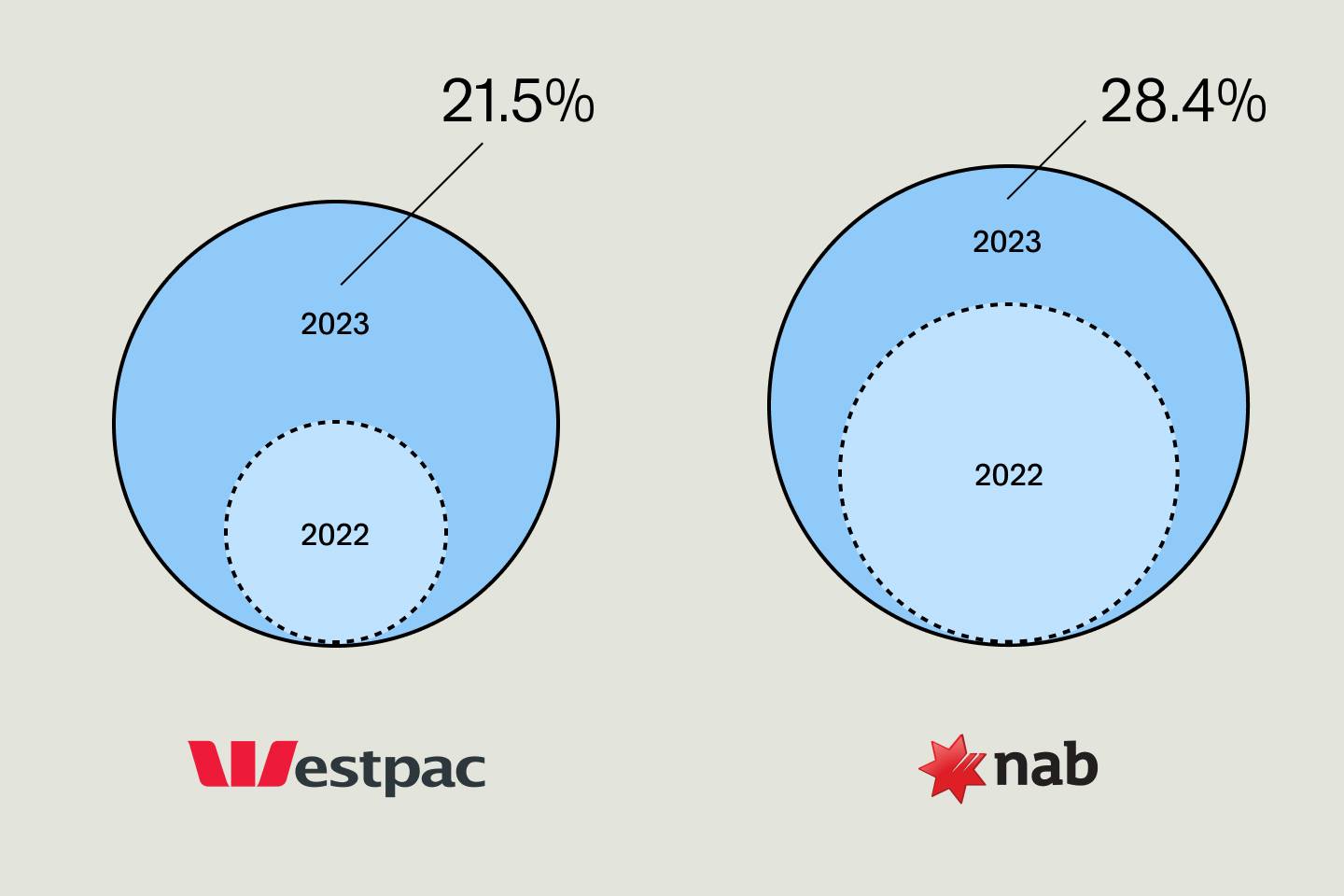

At these banks’ AGMs in December, Westpac and NAB revealed that 21.5% and 28.4% of their shareholders respectively had voted to support the climate-focused resolutions we co-filed with Market Forces. This represents a four-fold and doubling of support for these respective shareholder votes compared to the previous year.

Increased shareholders support for our co-filed climate-focused resolutions.

We think this is a pretty big deal. Here's why:

The Big 4 Australian banks have all introduced climate policies that, to varying extents, restrict lending to fossil fuel projects.

While this represents progress, it is not enough. It leaves a major loophole if climate restrictions are not applied to general corporate financing. Providing finance to the company developing the projects is still facilitating the projects going ahead.

We brought up this potential loophole at NAB’s 2022 AGM, only to be referred to the bank’s existing climate plan, a document we don’t think offers enough detail on how well banks are scrutinizing their lending customers.

The banks say that from 2025, they will only lend to companies with a credible transition plan in place. Although we think this gives fossil fuel companies too much time, if applied genuinely, this commitment should mean the banks will no longer provide new lending to oil and gas clients that are developing unsustainable new or expansionary oil and gas fields.

We need to make sure the banks apply this transition plan requirement with rigour. And, based on their disclosures and our direct engagements so far, we do not have sufficient comfort that they will.

For example, we don’t think NAB has been clear enough about whether they will expect their oil and gas customers’ transition plans to include scope 3 emissions (the emissions from burning the fossil fuels).1

Neither NAB nor Westpac have been clear about whether they will scrutinise their customers’ new capital expenditure, or lobbying activities, to assess the credibility of customer transition plans.2

The shareholder resolutions we put forward at the end of last year asked for better disclosure on these and other issues to give investors comfort the banks will genuinely implement their commitment to restrict lending to oil and gas companies to only those with a credible transition plan in place.

A shareholder resolution is a fancy way of saying, “let’s vote on something important”.

Where to from here?

The significant increase in support from bank shareholders for the climate resolutions creates a strong platform for us to build pressure on the banks to turn off financing for fossil fuels.

We plan to work with other shareholders and stakeholders to help ensure that when the banks start implementing these policies in 2025, they’re scrutinising their fossil fuel customers on issues like their scope 3 emissions, capital expenditure plans, use of offsets, technological assumptions and approach to climate lobbying. This should mean they rule out finance to fossil fuel companies that are developing new or expansionary fossil fuel projects that are inconsistent with keeping the planet within safe warming limits.

We want NAB to be clearer about whether they expect their oil and gas customers’ transition plans to include scope 3 emissions (the emissions from burning the fossil fuels).

Access to financing is the lifeblood of these projects, and although an oil and gas client may be able to obtain finance elsewhere, it may not be as on favourable terms particularly if the pool of available finance begins to restrict. Further, if the banks withdraw support for particular companies or sectors, this sends a clear market signal potentially opening the door for others, like government, to take stronger climate action.

The banks have a unique point of leverage to influence companies and help transition the economy more broadly. By making finance conditional on credible transition plans, they provide a consequence for inaction that threats of divestment by investors may not have – at least not as directly.

By applying pressure to bank lending through our stewardship activities in this way, we believe we’re creating influence for a better world that extends beyond where we’re investing our capital.

Shareholder resolutions 101

A shareholder resolution is a fancy way of saying, “let’s vote on something important”.

It’s a process used by shareholders to have their say on big decisions affecting listed companies. The decisions could be anything from how profits are distributed, to what a company’s climate policy should include. Many resolutions are voted on at company AGMs, but shareholder resolutions are a bit different because they are put up by a group of shareholders, not by company management.

Once a shareholder resolution is lodged, the company’s management and board review the resolution to make sure it’s valid and suitable for consideration. Shareholders are given notice about the resolution so they have time to mull it over. Shareholders then get to voice their opinions, ask questions and debate the proposal at company shareholder meetings. Votes are cast either in person or by proxy. Depending on the result the resolution either passes or fails – most resolutions require a majority vote in favour to pass.

Most shareholder resolutions do not pass, particularly in Australia. However, a large show of support for a resolution tells management that this is an issue they need to look at more closely.

1. NAB outlines its intention to consider Scope 3 emissions in its Customer Transition Plans on page 12 of its climate policy: 2023 Climate Report (nab.com.au). Westpac's is here: Climate_Change_Position_Statement_and_Action_Plan.pdf (westpac.com.au)

2. Australian Bank Shareholder Climate Resolutions: 2023-australian-bank-shareholder-climate-resolutions.pdf (australianethical.com.au)